Access the new E-commerce developers portal at docs.cielo.com.br.

Warning: The content on this page is being discontinued and will not receive updates after 09/16/2024. Please visit the new documentation at docs.cielo.br.

The purpose of this documentation is to guide the developer on how to integrate with API E-commerce Cielo, describing the features, methods to be used, listing information to be sent and received, and providing examples.

We recommend intermediate knowledge in web programming language, HTTP/HTTPS requests and JSON file manipulation are required to successfully deploy the E-commerce Cielo solution.

In this guide, you will find information on all operations available on API E-commerce Cielo. These operations must be performed using your credentials (MerchantId and MerchantKey) in the respective environment endpoints

| SandBox | Production | |

|---|---|---|

| Requests | https://apisandbox.cieloecommerce.cielo.com.br | https://api.cieloecommerce.cielo.com.br/ |

| Queries | https://apiquerysandbox.cieloecommerce.cielo.com.br | https://apiquery.cieloecommerce.cielo.com.br/ |

To perform an operation, combine the base URL of the environment with the URL of the desired operation and send it using the HTTP verb as described in the operation.

Download the tutorial to learn how to generate your MerchantId and MerchantKey credentials on Cielo portal.

The API E-commerce Cielo solution of the E-commerce Cielo platform was developed with REST technology, which is market standard and also independent of the technology used by our customers. In this way, it is possible to integrate using the most varied programming languages.

To get examples in these languages, see our conversion tutorial Postman Tutorial

Among other features, the attributes that stand out most in the Cielo e-commerce platform:

The model employed for the integration is quite simple since there are two URLs (endpoints):

To execute an operation:

| Method | Description |

|---|---|

| POST | The POST HTTP method is used in the creation of features or in sending information that will be processed. For example, creation of a transaction. |

| PUT | ThePUT HTTP method is used to update an already existing feature. For example, capture or cancelation of a previously authorized transaction. |

| GET | The GET HTTP method is used for querying already existing features. For example, transaction query. |

All operations require the access credentials MerchantId and MerchantKey, which must be sent in the header (header) of the request.

Each request sent will return an HTTP Status Code, indicating whether it was carried out successfully or not.

To facilitate understanding, we have listed below a short glossary with the main terms related to e-commerce and also to card and acquiring market:

| Terms | Description |

|---|---|

| Authentication | Process to ensure that the shopper is actually who they claim to be (lawful carrier), usually occurs at the issuing bank using a digital token or card with security keys. |

| Authorization | Process to check whether a purchase can or not be made with a card. At this point, several verifications are done with the card and the carrier (e.g., timely payments, card locks, etc.). It is also at this point that the card limit is checked with the transaction value. |

| Cancellation | Process to cancel a purchase made with a card. |

| Capture | Process that confirms an authorization that was previously made. It is only after the capture that the card carrier will be able to view it on their bank statement or invoice. |

| Shopper | It is the one who makes the purchase at the virtual store. |

| Issuer (or issuing bank) | It is the financial institution that issues the credit card, debit card or voucher. |

| Commercial establishment or CE | Entity that responds by the virtual store. |

| Payment Gateway | Company responsible for technical integration and transaction processing. |

| Carrier | It is the person who carries the card at the time of sale. |

| TID (Transaction Identifier) | Code consisting of 20 characters that identifies a Cielo e-commerce transaction. |

The current version of Cielo Webservice supports the following issuers and products:

| Issuer | Demand credit | Installment credit Store | Debit | Voucher | International |

|---|---|---|---|---|---|

| Visa | Yes | Yes | Yes | No | Yes |

| Master Card | Yes | Yes | Yes | No | Yes |

| American Express | Yes | Yes | No | No | Yes |

| Elo | Yes | Yes | Yes | No | Yes |

| Diners Club | Yes | Yes | No | No | Yes |

| Discover | Yes | No | No | No | Yes |

| JCB | Yes | Yes | No | No | Yes |

| Aura | Yes | Yes | No | No | Yes |

| Hipercard | Yes | Yes | No | No | No |

If you have any questions, feel free to contact us through our e-mail: cieloecommerce@cielo.com.br

The SSL Certificate for web servers confirms the authenticity and integrity of the website data, giving customers of virtual stores the guarantee that they are actually accessing the website they want, not a fraudulent website.

Specialized companies are responsible for validating the domain and, depending on the type of certificate, they are also responsible for the validation of the entity that owns the domain.

The EV Certificate ensures a higher level of security for virtual stores customers.

It is a more trustworthy certificate and when HTTPS is accessed the address bar will turn green, showing more reliability for users.

You just have to install the following files in the server Trustedstore. Cielo does not offer support to the installation of the Certificate. If you are unsure about how to install the EV Certificate, then you should contact your server vendor support.

For the the step-by-step of the EV Certificate installation, you must contact your server vendor support.

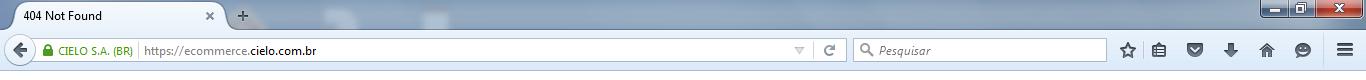

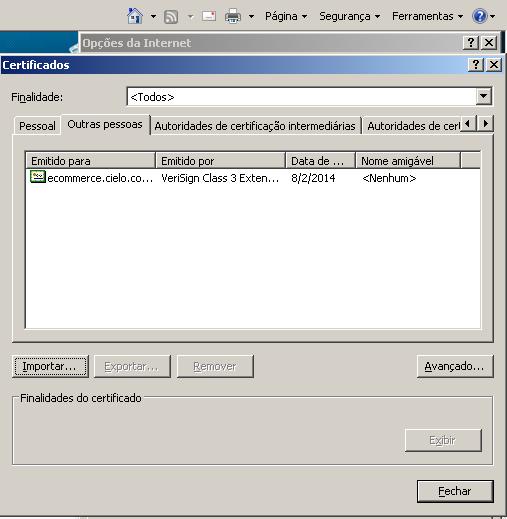

Usually, the browser automatically updates the Certificate. If it does not and the client reaches out, the following steps must be informed:

Step 1:

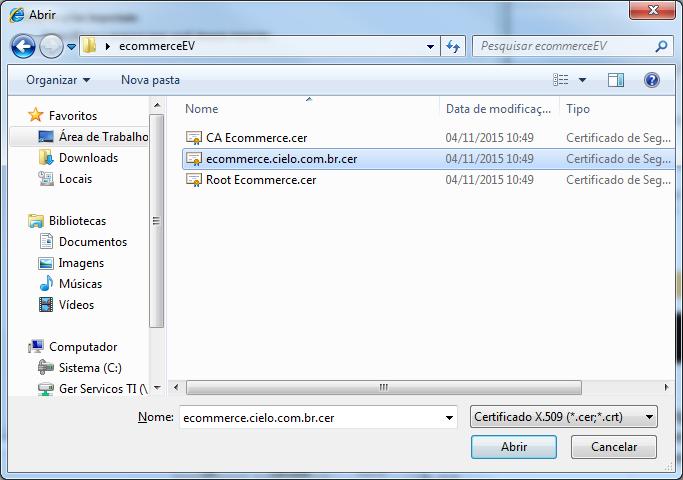

Save these files below into a new folder, or into a folder that can be easily accessed, as it will be used later:

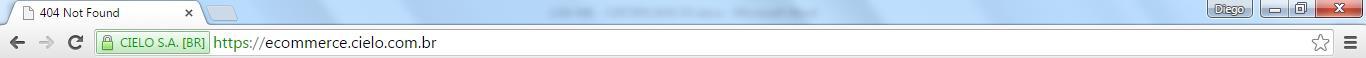

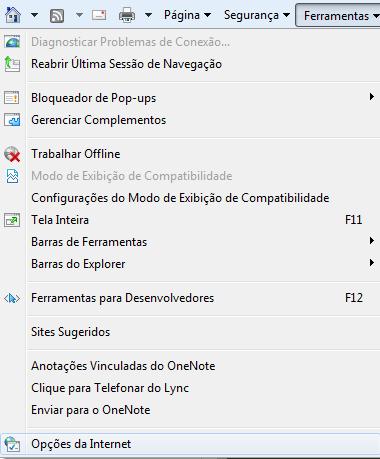

Step 2:

On Internet Explorer, click on Tools and go to Internet Options:

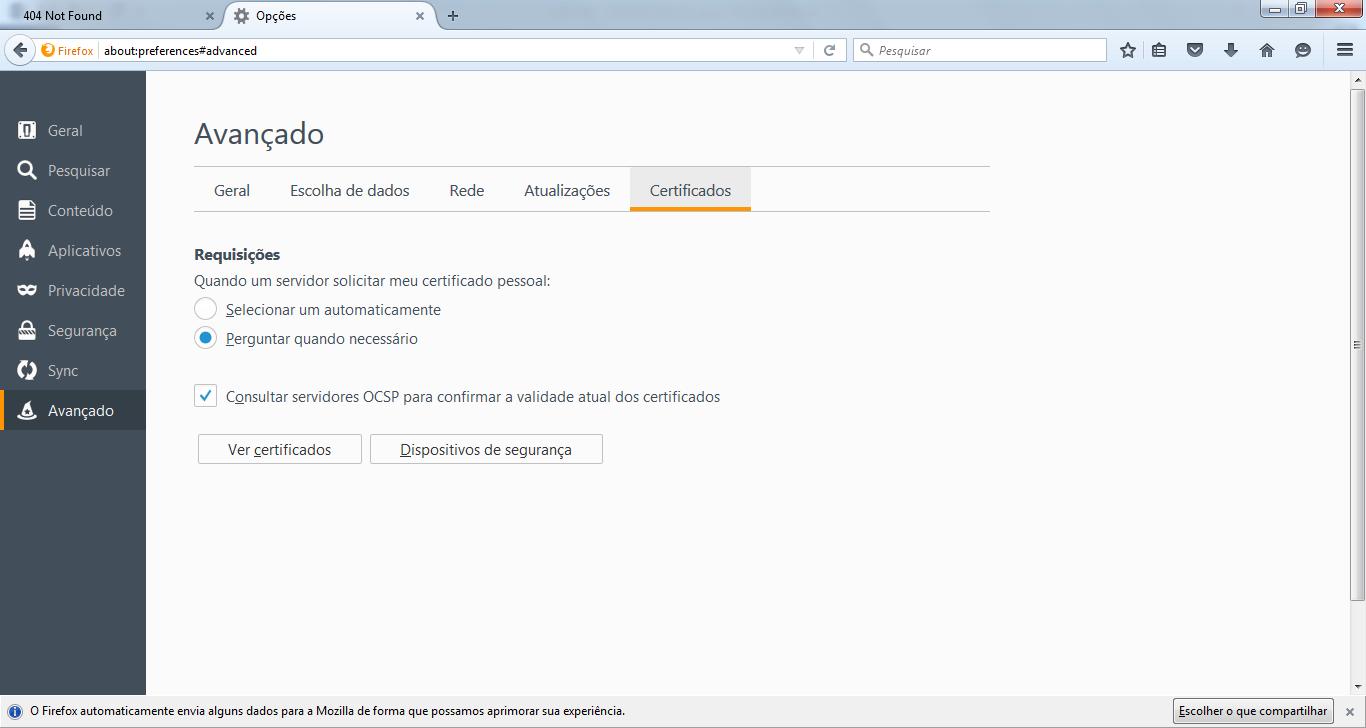

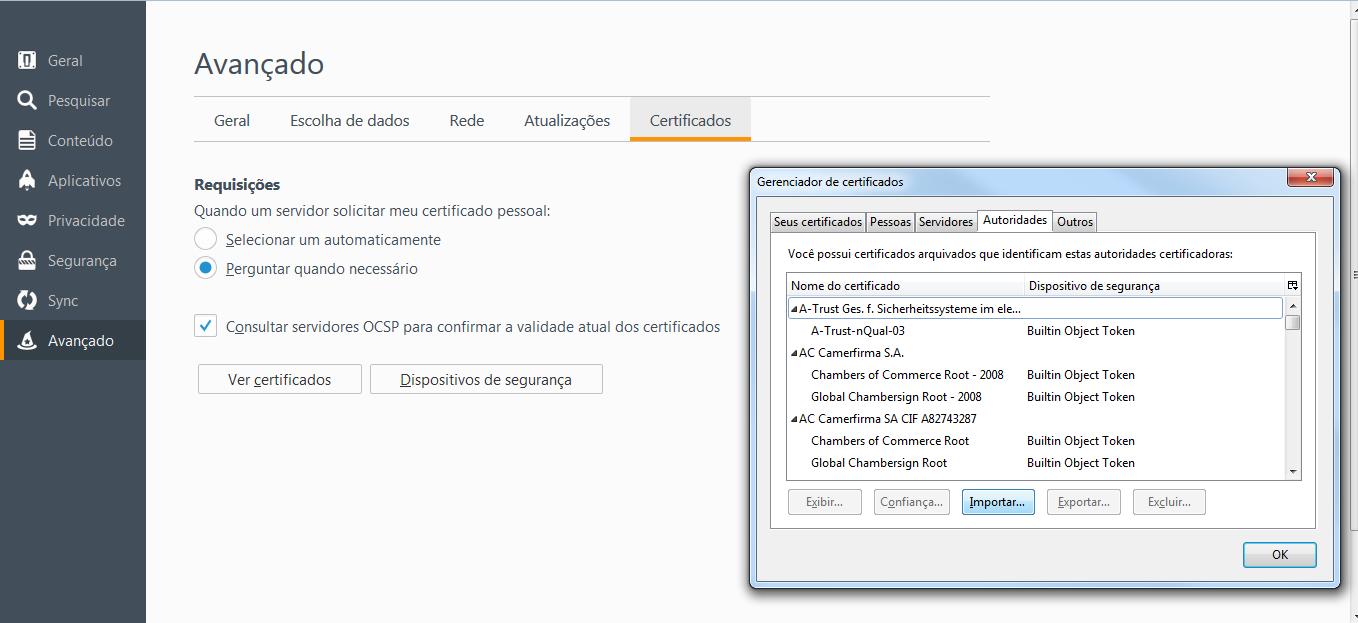

On Firefox, click on Open Menu and go to Advanced > Options:

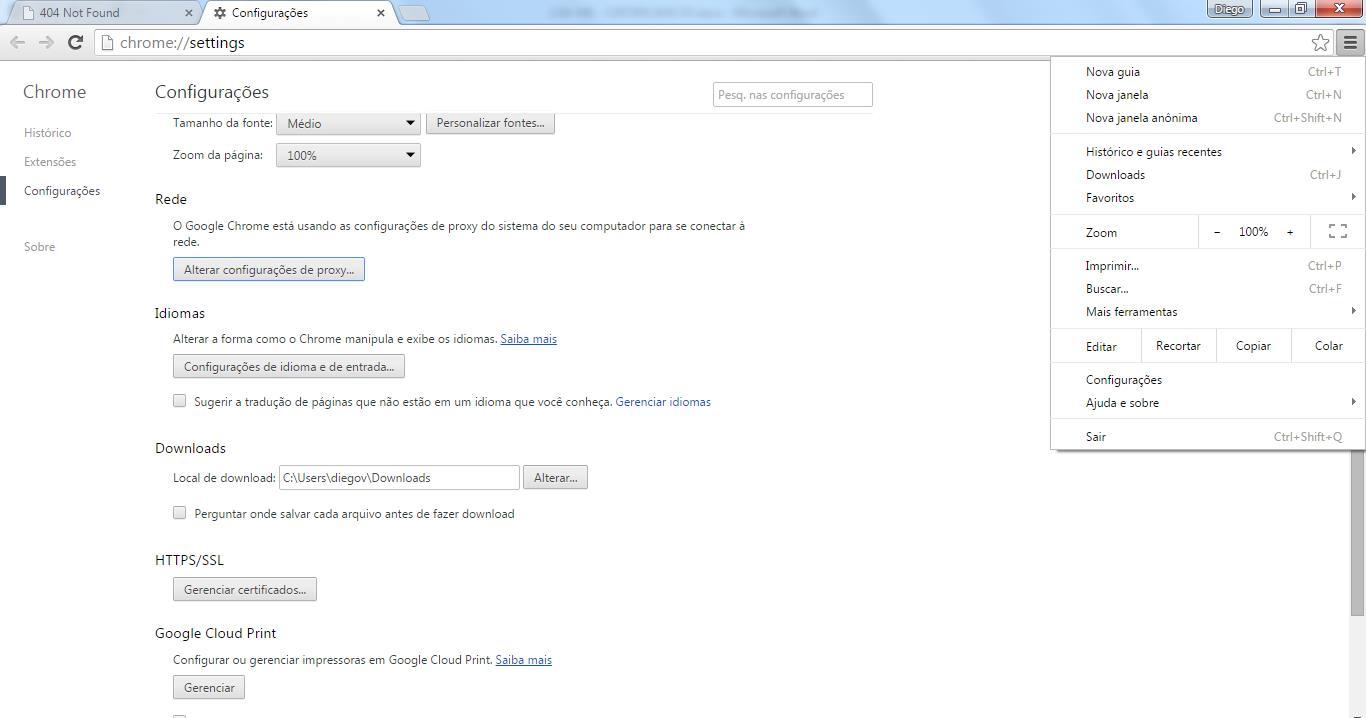

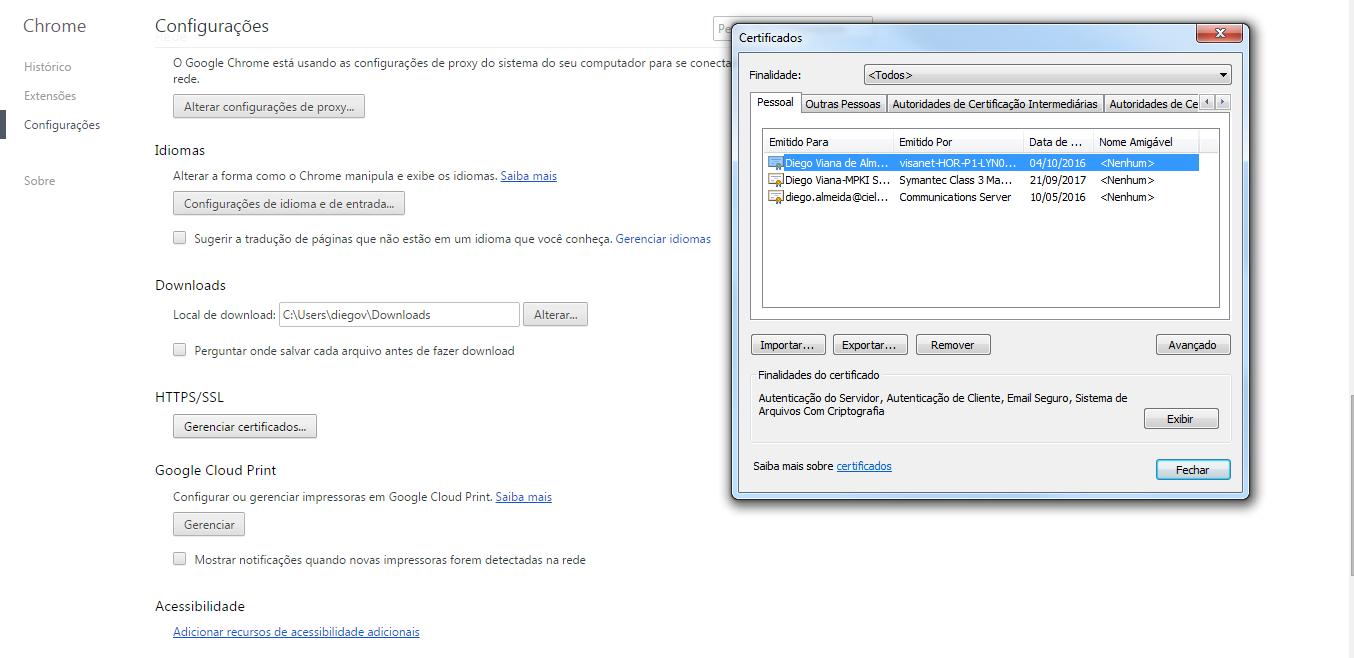

On Google Chrome, click on Control Google Chrome and go to Settings > Show advanced settings… > Change Proxy Settings… > Content > Certificates:

Step 3:

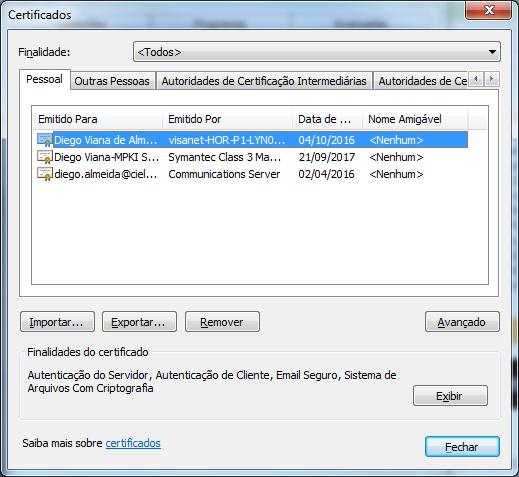

On Internet Explorer, under Certificates, click on *Import…:

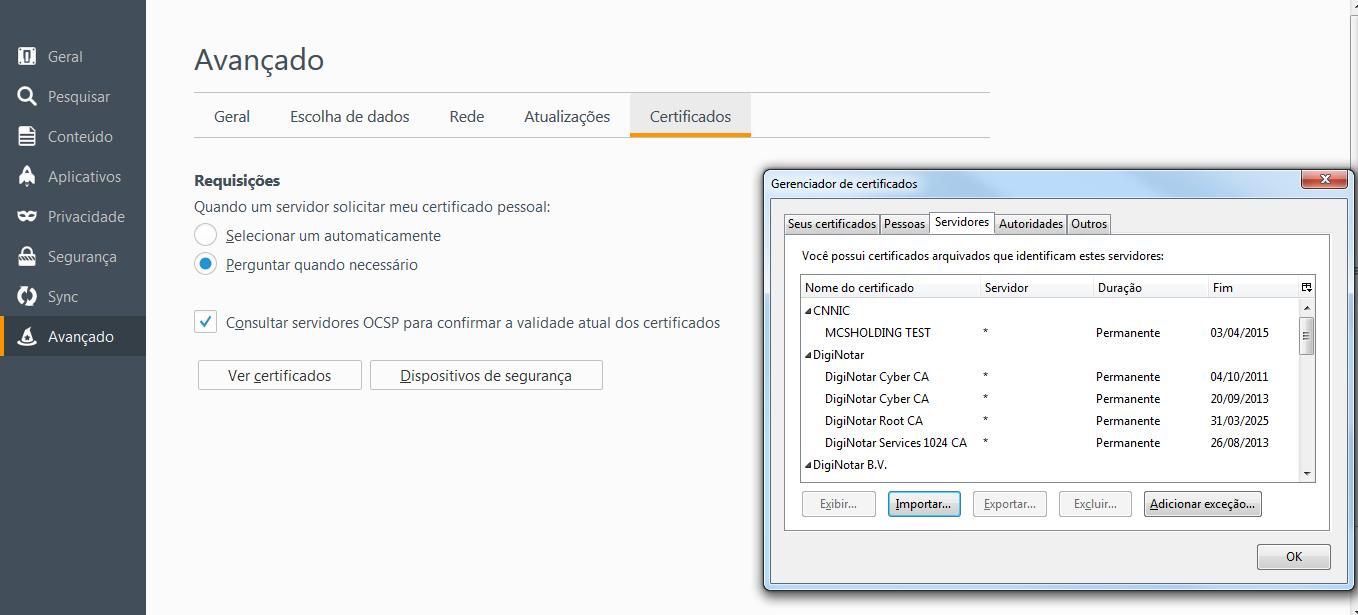

On Firefox, go on View Certificates, click on Import…:

On Chrome, go on Manage Certificates…, click on Import:

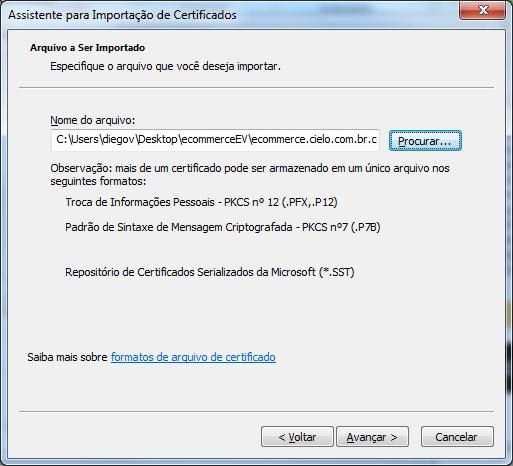

Step 4:

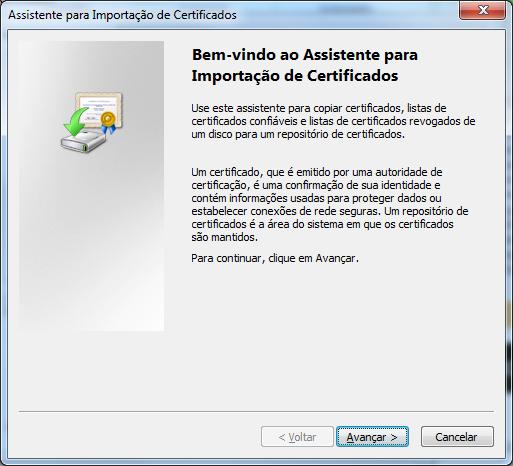

On Internet Explorer and Chrome, under Certificate Import Wizard, click on Next:

On Firefox, under Servers, click on Import…:

Step 5:

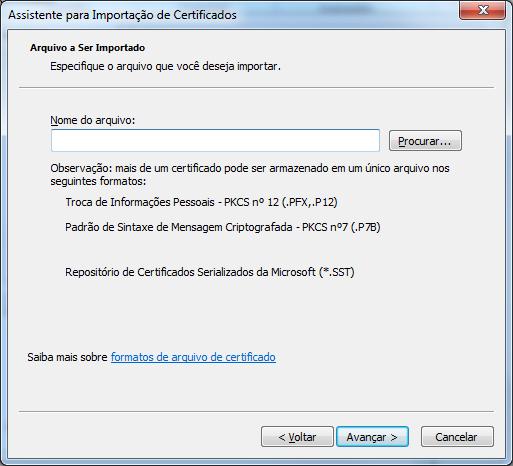

On Chrome and Internet Explorer, under Certificate Import Wizard, click on Search, look for the folder where the files are and select the file cieloecommerce.cielo.com.br.crt, click on Open and then Next.

Step 6:

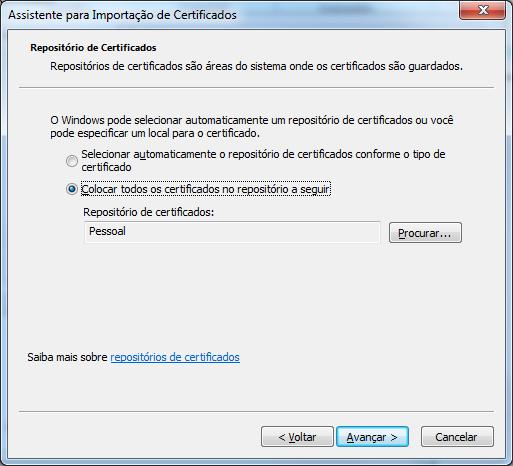

Select the desired option: add the Certificate in a default folder or search for the folder of your choice.

Step 7:

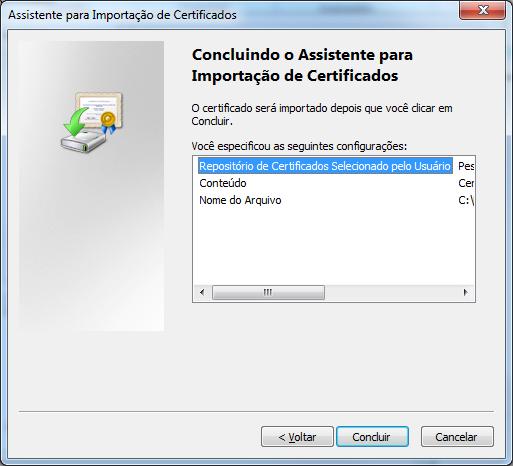

Click on Finish.

Step 8:

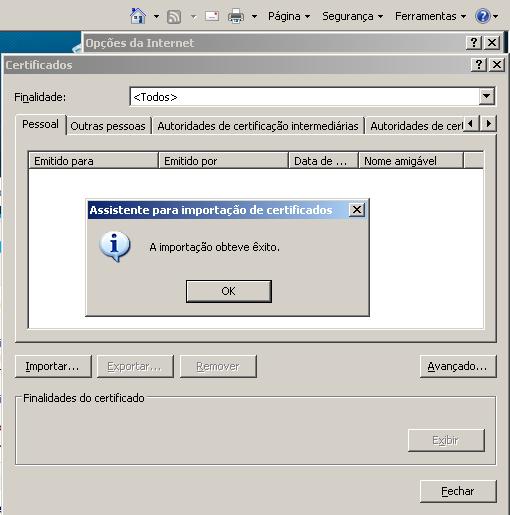

Click on Ok to complete the import.

The Certificate may be viewed in the default tab Other People or at the one chosen by the customer.

Step 9:

Repeat the same procedure for the 3 sent files.

To facilitate testing during integration, Cielo offers a Sandbox environment that allows simuation of the API messages. The Sandbox environment is programmed to give you responses for every feature available on API E-commerce Cielo

| INFORMATION | URL |

|---|---|

| Access credentials | MerchantId and MerchantKey obtained after creating your testing account on Sandbox Registration |

| Requests URL | https://apisandbox.cieloecommerce.cielo.com.br |

| Queries URL | https://apiquerysandbox.cieloecommerce.cielo.com.br |

Perks of using Sandbox

You can use Postman to test your integration, using the API E-commerce Cielo collection.

Importation link: https://www.postman.com/collections/7313fe78130211f5f009

| Environment | Endpoints |

|---|---|

| Sandbox | Request: https://apisandbox.cieloecommerce.cielo.com.br Query: https://apiquerysandbox.cieloecommerce.cielo.com.br/ |

| Production | Request: https://api.cieloecommerce.cielo.com.br/ Query: https://apiquery.cieloecommerce.cielo.com.br/ |

Download the Environment Production and Sandbox file and replace MerchantID and MerchantKeys with your store’s information.

With this payment method it is possible to simulate the flows of:

To make better use of a simulated payment, you can create a fake card number using a generator online or choosing random numbers. For either option, the first 15 digits can be random, but the last one should correspond to the transaction status you want to test.

The Security Code (CVV) and expiration date information may be random, keeping the format - CVV (3 digits) and Validity (MM/YYYY).

| Final card digit | Transaction Status | Return Code | Return Message |

|---|---|---|---|

| XXXX.XXXX.XXXX.XXX0 XXXX.XXXX.XXXX.XXX1 XXXX.XXXX.XXXX.XXX4 |

Authorized | 4/6 | Operation performed successfully |

| XXXX.XXXX.XXXX.XXX2 | Not Authorized | 05 | Not Authorized |

| XXXX.XXXX.XXXX.XXX3 | Not Authorized | 57 | Expired Card |

| XXXX.XXXX.XXXX.XXX5 | Not Authorized | 78 | Blocked Card |

| XXXX.XXXX.XXXX.XXX6 | Not Authorized | 99 | Time Out |

| XXXX.XXXX.XXXX.XXX7 | Not Authorized | 77 | Canceled Card |

| XXXX.XXXX.XXXX.XXX8 | Not Authorized | 70 | Problems with the Credit Card |

| XXXX.XXXX.XXXX.XXX9 | Random Authorization | 4 a 99 | Operation Successful / Time Out |

The test card 4024.0071.5376.3191, for example, would simulated a successful transaction.

To check the return codes in Production, check API Codes.

With this payment method, it is possible to simulate the flows of:

The debit transaction needs to be authenticated:

| Option | Status |

|---|---|

| Authenticated | Authorized |

| Not Authenticated | Denied |

| Do not use the URL | Not Finished |

Online Transfer: The same behavior of debit card in Sandbox is valid for debit card.

Other payment methods do not have cards or specific simulated data, as in the case of credit cards. Below we specify any existing differences:

| Payment Method | Orientations for Sandbox |

|---|---|

| Boleto | To send a boleto transaction in the Sandbox environment you should put the Provider as Simulado.There is no bank validation. The boleto behaves as a boleto without registration. |

| Alelo | Use the same values from the request at the Production environment for Alelo Cards. |

| QR Code | Use the same values from the resquest at the Production environment for QR Code. There is no bank conciliation. |

| Carnê | Use the same values from the request at the Production environmnet for Carnê Transaction. |

| Electronic Transfer | The Provider used should be “Simulado”. The redirecting URL for the bank environment will be a screen for you to choose the status of the authentication. |

To simulate a transaction with return for a new card, updated by our service Renova Fácil, follow the instructions below.

In the authorization request, besides the fields already mentioned for the used method of payment, you need the send the following:

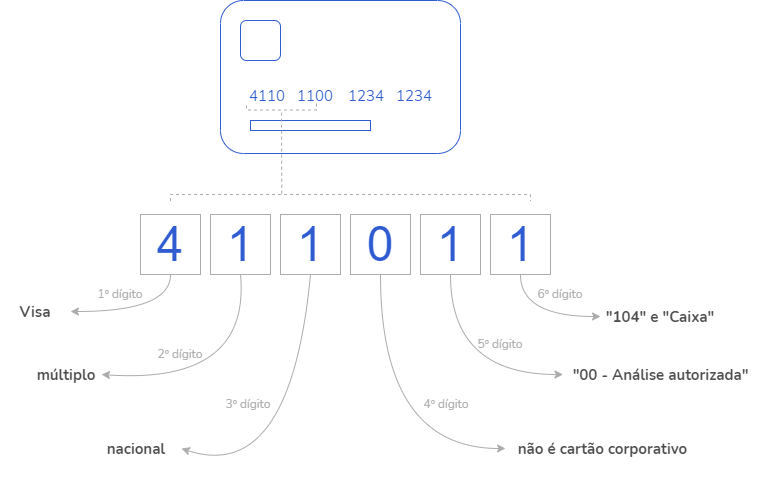

CreditCard.CardNumber: send a card with 3 as the final digit, which simulates an expired card.CreditCard.ExpirationDate: send an expiration date that has passed.Payment.Recurrent as true, to mark the transaction as recurring.A card’s BIN code is the first six digits of the card number. At the Consulta BIN simulation in the Sandbox environment, each one of the six digits will determine a simulated result.

It is possible to test different card numbers and observe the expected return according to the different options.

A card’s BIN code should return the card brand, the type of card, the nationality, if it is a corporate card, the return of the BIN analysis and the card issuer. To know more, read the Consulta BIN section of this guide.

| Digit | Meaning | Return |

|---|---|---|

| 1st digit | Brand. | If it’s ‘3’ it returns “AMEX“ If it’s ‘5’ it returns “MASTERCARD“ If it’s ‘6’ it returns “DISCOVER“ Every other number returns “VISA”. |

| 2nd digit | Type of card | If it’s ‘3’ it returns “Débito“ If it’s ‘5’ it returns “Crédito“ If it’s ‘7’ it returns “Crédito” and it returns the Prepaid field as “true“Any other number returns “Múltiplo”. |

| 3rd digit | Card nationality | If it’s ‘1’ it returns “true” (national card) Every other number other than ‘1’ returns “false” (international card). |

| 4th digit | If it’s a corporate card | If it’s ‘1’ it returns “true” (it is a corporate card) Every other number other than ‘1’ returns “false” (not a corporate card). |

| 5th digit | Analysis return | If it’s ‘2’ it returns “01 - Bandeira não suportada“ If it’s ‘3’ it returns “02 - Voucher - Não suportado na consulta de bins“ Every other number returns “00 - Analise autorizada” |

| 6th digit | Issuing bank | If it’s ‘1’ it returns “104” and “Caixa“ If it’s ‘2’ it returns “001” and “Banco do Brasil“ Every other number returns “237” e “Bradesco” |

Example

A card with the number 4110110012341234 will return the following data:

curl

--request GET https://apiquerysandbox.cieloecommerce.cielo.com.br/1/cardBin/411011

--header "Content-Type: application/json"

--data-binary

--verbose

{

"Status": "00",

"Provider": "VISA",

"CardType": "Multiplo",

"ForeignCard": false,

"CorporateCard": false,

"Issuer": "Banco do Brasil",

"IssuerCode": "001"

}

curl

{

"Status": "00",

"Provider": "VISA",

"CardType": "Multiplo",

"ForeignCard": false,

"CorporateCard": false,

"Issuer": "Banco do Brasil",

"IssuerCode": "001"

}

--verbose

To enjoy all the features available in our API, it is important that you first understand the concepts around processing a credit card transaction.

| Concept | Description |

|---|---|

| Authentication | The authentication process makes it possible to effective a sale, which will pass through the authentication process of the card issuing bank, then providing more security for the sale and transferring the risk of fraud to the bank. |

| Authorization | The authorization (or pre-authorization) is the main operation in the eCommerce, because through it, the sale can be finished. Pre-authorization only sensitizes the customer’s limit, but still does not generate charge for the consumer. |

| Capture | When making a pre-authorization, it is necessary to confirm it, so that the charge is effected to the card carrier. It is through this operation a pre-authorization is effected, and it can be executed normally within 5 days after the pre-authorization date. |

| Cancellation | The cancellation is necessary when, for some reason, a sale will not be effected anymore. |

To create a credit card transaction, you need to send a request using the POST method, as shown. This example covers all the possible fields you can send; check which fields are required in the request properties table.

The transaction capture can be authomatic or posterior. For an authomatic capure, send the

Payment.Capturefield in the request as “true”. For a posterior capture, send the field as “false” and then do the capture request.

Warning: It is not possible to carry out a transaction with its value (

Amount) as 0. To verify if a card is valid, use Zero Auth.

Mastercard credit card transactions with stored credentials: the Mastercard brand requires the Transaction Initiator Indicator for credit and debit card transactions using stored card data. The goal is to indicate if the transaction was initiated by the cardholder or by the merchant. In this scenario, the node

InitiatedTransactionIndicatormust be sent with the parametersCategoryandSubCategoryfor Mastercard transactions, within thePaymentnode. Please check the complete list of categories in theCategoryparameter description and the subcategories tables in Transaction Indicator Tables.

Please refer to Credit card with authentication to create an authenticated credit card transaction.

{

"MerchantOrderId": "2014111701",

"Customer": {

"Name": "Comprador crédito completo",

"Email": "compradorteste@teste.com",

"Birthdate": "1991-01-02",

"Address": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"DeliveryAddress": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"Billing": {

"Street": "Rua Neturno",

"Number": "12345",

"Complement": "Sala 123",

"Neighborhood": "Centro",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BR",

"ZipCode": "20080123"

}

},

"Payment": {

"Currency": "BRL",

"Country": "BRA",

"ServiceTaxAmount": 0,

"Installments": 1,

"Interest": "ByMerchant",

"Capture": true,

"Authenticate": "false",

"Recurrent": "false",

"SoftDescriptor": "123456789ABCD",

"Tip":false,

"CreditCard": {

"CardNumber": "1234123412341231",

"Holder": "Teste Holder",

"ExpirationDate": "12/2030",

"SecurityCode": "123",

"SaveCard": "false",

"Brand": "Visa",

"CardOnFile": {

"Usage": "Used",

"Reason": "Unscheduled"

}

},

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

"IsCryptoCurrencyNegotiation": true,

"Type": "CreditCard",

"Amount": 15700,

"AirlineData": {

"TicketNumber": "AR988983"

}

}

}

curl

--request POST "https://apisandbox.cieloecommerce.cielo.com.br/1/sales/"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--header "MerchantKey: 0123456789012345678901234567890123456789"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId":"2014111701",

"Customer":{

"Name":"Comprador crédito completo",

"Identity":"11225468954",

"IdentityType":"CPF",

"Email":"compradorteste@teste.com",

"Birthdate":"1991-01-02",

"Address":{

"Street":"Rua Teste",

"Number":"123",

"Complement":"AP 123",

"ZipCode":"12345987",

"City":"Rio de Janeiro",

"State":"RJ",

"Country":"BRA"

},

"DeliveryAddress": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"Billing": {

"Street": "Rua Neturno",

"Number": "12345",

"Complement": "Sala 123",

"Neighborhood": "Centro",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BR",

"ZipCode": "20080123"

}

},

"Payment":{

"ServiceTaxAmount":0,

"Installments":1,

"Interest":"ByMerchant",

"Capture":true,

"Authenticate":false,

"Recurrent":"false",

"SoftDescriptor":"123456789ABCD",

"Tip":false,

"CreditCard":{

"CardNumber":"4551870000000183",

"Holder":"Teste Holder",

"ExpirationDate":"12/2030",

"SecurityCode":"123",

"SaveCard":"false",

"Brand":"Visa",

"CardOnFile":{

"Usage": "Used",

"Reason":"Unscheduled"

}

},

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

"IsCryptoCurrencyNegotiation": true,

"Type":"CreditCard",

"Amount":15700,

"AirlineData":{

"TicketNumber":"AR988983"

}

}

}

--verbose

| Property | Type | Size | Required | Description |

|---|---|---|---|---|

MerchantId |

GUID | 36 | Yes | Store identifier in Cielo. |

MerchantKey |

text | 40 | Yes | Public Key for Double Authentication in Cielo. |

Content-Type |

header | 40 | Yes | application/json (required). |

RequestId |

GUID | 36 | No | Request identifier, used when the merchant uses different servers for each GET/POST/PUT. |

MerchantOrderId |

text | 50 | Yes | Order identification number. Warning: Allowed characters are a-z, A-Z, 0-9. Special characters and blank spaces are not allowed. |

Customer.Name |

text | 255 | No | Customer’s name. |

Customer.Status |

text | 255 | No | The customer’s registration status on the store. (NEW / EXISTING). |

Customer.Identity |

text | 14 | No | Customer’s RG, CPF or CNPJ. |

Customer.IdentityType |

text | 255 | No | Customer’s type of identification (CPF/CNPJ). |

Customer.Email |

text | 255 | No | Customer’s e-mail. |

Customer.Birthdate |

date | 10 | No | Customer’s birth date (AAAA/MM/DD). |

Customer.Address.Street |

text | 255 | No | Customer’s address. |

Customer.Address.Number |

text | 15 | No | Customer’s address number. |

Customer.Address.Complement |

text | 50 | No | Customer’s address complement. |

Customer.Address.ZipCode |

text | 9 | No | Customer’s Zip Code. |

Customer.Address.City |

text | 50 | No | Customer’s address’ city. |

Customer.Address.State |

text | 2 | No | Customer’s address’ state. |

Customer.Address.Country |

text | 35 | No | Customer’s address’ country. |

Customer.DeliveryAddress.Street |

text | 255 | No | Customer’s delivery address. |

Customer.Address.Number |

text | 15 | No | Customer’s delivery address number. |

Customer.DeliveryAddress.Complement |

text | 50 | No | Customer’s delivery address complement. |

Customer.DeliveryAddress.ZipCode |

text | 9 | No | Customer’s delivery address Zip Code. |

Customer.DeliveryAddress.City |

text | 50 | No | Customer’s delivery address city. |

Customer.DeliveryAddress.State |

text | 2 | No | Customer’s delivery address state. |

Customer.DeliveryAddress.Country |

text | 35 | No | Customer’s delivery address country. |

Customer.Billing.Street |

string | 24 | No | Customer’s billing address. |

Customer.Billing.Number |

string | 5 | No | Customer’s billing address number. |

Customer.Billing.Complement |

string | 14 | No | Customer’s billing address complement. |

Customer.Billing.Neighborhood |

string | 15 | No | Customer’s billing address neighborhood. |

Customer.Billing.City |

string | 20 | No | Customer’s billing address city. |

Customer.Billing.State |

string | 2 | No | Customer’s billing address state. |

Customer.Billing.Country |

string | 2 | No | Customer’s billing address country. More information at ISO 2-Digit Alpha Country Code |

Customer.Billing.ZipCode |

string | 9 | No | Customer’s billing address Zip Code. |

Payment.Type |

text | 100 | Yes | Type of the payment method. |

Payment.Amount |

number | 15 | Yes | Order Amount (to be sent in cents). |

Payment.Currency |

text | 3 | No | Currency in which the payment will be made (BRL). |

Payment.Country |

text | 3 | No | Country in which the payment will be made. |

Payment.Provider |

text | 15 | — | Defines the behavior for the payment method/NOT REQUIRED FOR CREDIT. |

Payment.ServiceTaxAmount |

number | 15 | No | Appliable only to airline companies. Order amounth that will be destined to service tax. PS.: This amount is not added to the authorization amount. |

Payment.SoftDescriptor |

text | 13 | No | The store’s name that will be on the shopper’s bank invoice. Does not allow special characters. |

Payment.Tip |

boolean | — | No (Default false) | Tipping is a type of transaction available for credit or debit card, tokenized or not. If “true”, the transaction is identified as a tip, otherwise send Tip as “false”. |

Payment.Installments |

number | 2 | Yes | Number of installments. If the transaction is a recurrence, the number of installments will be 1. For installment transactions, the number of installments will be greater than 1. |

Payment.Interest |

text | 10 | No | Type of installments - Store (ByMerchant) or Card (ByIssuer). |

Payment.Capture |

boolean | — | No (Default false) | Boolean that identifies if the authorization should be done by Authomatic capture (true) or posterior capture (false). |

Payment.Authenticate |

boolean | — | No (Default false) | Defines if the shopper will be directed to the issuing bank for a card authetication. |

Payment.Recurrent |

boolean | - | Conditional | Indicates if the transaction is recurring (“true”) or not (“false”). The value “true” won’t originate a new recurrence, it will only allow a transaction without the need to send the security code. Authenticate should be “false” if Recurrent is “true”. Find out more about Recurring Payments. |

Payment.IsCryptocurrencyNegotiation |

boolean | - | No (default false) | Should be send as “true” if the transaction is to sell or buy criptocurrency. |

Payment.AirlineData.TicketNumber |

alphanumeric | 13 | No | Inform the number of the main airline ticket of the transaction. |

Payment.CreditCard.CardNumber |

text | 19 | Yes | Shopper’s card number. |

Payment.CreditCard.Holder |

text | 25 | Yes | Name of the shopper that’s printed on the card. Does not accept special characters. |

Payment.CreditCard.ExpirationDate |

text | 7 | Yes | Expiration date printed on the card. Example: MM/AAAA. |

Payment.CreditCard.SecurityCode |

text | 4 | No | Security code printed on the back of the card. |

Payment.CreditCard.SaveCard |

boolean | — | No (Default false) | Boolean that identifies if the card will be saved to generate a CardToken. Find out more about Tokenization of Cards. |

Payment.CreditCard.Brand |

text | 10 | Yes | Card brand. Possible values: Visa / Master / Amex / Elo / Aura / JCB / Diners / Discover / Hipercard / Hiper. |

Payment.CreditCard.CardOnFile.Usage |

text | - | No | First if the card was stored and it’s your first use. Used if the card was stored and has been used for another transaction before. Find out more about Card On File. |

Payment.CreditCard.CardOnFile.Reason |

text | - | Conditional | Indicates the motive for card storage, if the “Usage” field is “Used”. Recurring - Programmed recurring transaction (e.g. Subscriptions). If it is a recurring transaction, use Payment.Recurrent = true (merchant recurrence) or Recurrent.Payment = true (scheduled recurrence). Unscheduled - Recurring transaction with no fixed date (e.g. service apps) Installments - Installments through recurring transactions. Get more information on the topic Card On File |

Payment.InitiatedTransactionIndicator.Category |

string | 2 | Conditional. Required only for Mastercard. | Transaction Initiator Indicator category. Valid only for Mastercard. Possible values: - “C1”: transaction initiated by the cardholder; - “M1”: recurring payment or installment initiated by the merchant - “M2”: transaction initiated by the merchant. |

Payment.InitiatedTransactionIndicator.Subcategory |

string | - | Conditional. Required only for Mastercard. | Transaction Initiator Indicator subcategory. Valid only for Mastercard. Please refer to the Transaction Initiator Indicator tables for the full list. |

{

"MerchantOrderId": "2014111706",

"Customer": {

"Name": "Comprador crédito completo",

"Identity": "11225468954",

"IdentityType": "CPF",

"Email": "compradorteste@teste.com",

"Birthdate": "1991-01-02",

"Address": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"DeliveryAddress": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"Billing": {

"Street": "Rua Neturno",

"Number": "12345",

"Complement": "Sala 123",

"Neighborhood": "Centro",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BR",

"ZipCode": "20080123"

}

},

"Payment": {

"ServiceTaxAmount": 0,

"Installments": 1,

"Interest": "ByMerchant",

"Capture": true,

"Authenticate": false,

"Tip":false,

"CreditCard": {

"CardNumber": "455187******0183",

"Holder": "Teste Holder",

"ExpirationDate": "12/2030",

"SaveCard": false,

"Brand": "Visa",

"PaymentAccountReference": "92745135160550440006111072222",

"CardOnFile": {

"Usage": "Used",

"Reason": "Unscheduled"

}

},

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

"IsCryptoCurrencyNegotiation": true,

"TryAutomaticCancellation": true,

"ProofOfSale": "674532",

"Tid": "0305020554239",

"AuthorizationCode": "123456",

"SoftDescriptor": "123456789ABCD",

"PaymentId": "24bc8366-fc31-4d6c-8555-17049a836a07",

"Type": "CreditCard",

"Amount": 15700,

"CapturedAmount": 15700,

"Country": "BRA",

"AirlineData": {

"TicketNumber": "AR988983"

},

"ExtraDataCollection": [],

"Status": 2,

"ReturnCode": "6",

"ReturnMessage": "Operation Successful",

"MerchantAdviceCode": "1",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.cieloecommerce.cielo.com.br/1/sales/{PaymentId}"

},

{

"Method": "PUT",

"Rel": "void",

"Href": "https://apisandbox.cieloecommerce.cielo.com.br/1/sales/{PaymentId}/void"

}

]

}

}

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId": "2014111706",

"Customer": {

"Name": "Comprador crédito completo",

"Identity":"11225468954",

"IdentityType":"CPF",

"Email": "compradorteste@teste.com",

"Birthdate": "1991-01-02",

"Address": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"DeliveryAddress": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"Billing": {

"Street": "Rua Neturno",

"Number": "12345",

"Complement": "Sala 123",

"Neighborhood": "Centro",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BR",

"ZipCode": "20080123"

}

},

"Payment": {

"ServiceTaxAmount": 0,

"Installments": 1,

"Interest": "ByMerchant",

"Capture": true,

"Authenticate": false,

"Tip":false,

"CreditCard": {

"CardNumber": "455187******0183",

"Holder": "Teste Holder",

"ExpirationDate": "12/2030",

"SaveCard": false,

"Brand": "Visa",

"PaymentAccountReference":"92745135160550440006111072222",

"CardOnFile":{

"Usage": "Used",

"Reason":"Unscheduled"

}

},

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

"IsCryptoCurrencyNegotiation": true,

"TryAutomaticCancellation":true,

"ProofOfSale": "674532",

"Tid": "0305020554239",

"AuthorizationCode": "123456",

"SoftDescriptor":"123456789ABCD",

"PaymentId": "24bc8366-fc31-4d6c-8555-17049a836a07",

"Type": "CreditCard",

"Amount": 15700,

"CapturedAmount": 15700,

"Country": "BRA",

"ExtraDataCollection": [],

"Status": 2,

"ReturnCode": "6",

"ReturnMessage": "Operation Successful",

"MerchantAdviceCode":"1",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.cieloecommerce.cielo.com.br/1/sales/{PaymentId}"

},

{

"Method": "PUT",

"Rel": "void",

"Href": "https://apisandbox.cieloecommerce.cielo.com.br/1/sales/{PaymentId}/void"

}

]

}

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

ProofOfSale |

Authorization number, identical to NSU. | text | 6 | Alphanumeric text |

Tid |

Transaction Id on the acquirer. | text | 20 | Alphanumeric text |

AuthorizationCode |

Authorization code. | text | 6 | Alphanumeric text |

SoftDescriptor |

Text that will be printed on the carrier’s bank invoice. Does not allow special characters. | text | 13 | Alphanumeric text |

PaymentId |

Payment ID number, needed for future operations like Consulting, Capture and Cancellation. | GUID | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

ECI |

Eletronic Commerce Indicator. Indicates how safe a transaction is. | text | 2 | Examples: 7 |

Status |

Transaction status. Check out the complete Transactional status codes table. | byte | — | 2 |

ReturnCode |

Acquiring return code. | text | 32 | Alphanumeric text |

ReturnMessage |

Acquiring return message. | text | 512 | Alphanumeric text |

Payment.MerchantAdviceCode |

Card brand’s return code that defines the period for transaction submission retry. Valid only for Mastercard. See more at Mastercard retry program | text | 2 | Number |

TryAutomaticCancellation |

In case of error during authorization (status “Not Finished - 0”), the response will include the “tryautomaticcancellation” field as “true”. In this case, the transaction will be automatically queried, and if it has been authorized successfully, it will be canceled automatically. This feature must be enabled for establishment. To enable, please contact our technical support. | boolean | - | true ou false |

Payment.CreditCard.PaymentAccountReference |

PAR (payment account reference) is the number that associates different tokens to the same card. It will be returned by the Master and Visa brands and passed on to Cielo e-commerce customers. If the card brand doesn’t send the information the field will not be returned. | alphanumeric | 29 | — |

This payment method is automatically released along to the Cielo’s affiliation.

Every debit transaction should be authenticated by demand of the issuing banks and card brands, to ensure better safety.

To authenticate a debit transaction, we use the EMV 3DS 2.0 protocol; this protocol is a script integrated to your e-commerce that verifies the identity of the shopper while keeping a positive shopping experience and reducing the risk of fraud.

To integrate the authentication method, check the 3DS 2.0 documentation.

Debit without authentication: or “debit without password”, can only be done when the e-commerce has the issuing bank’s authorization to dismiss the authentication. In case you have that permission, send the field

Authenticateas “false” in the standard request for debit card.

To sell with a debit card, you should request using the POST method. The example below shows the minimum necessary fields that should be sent for the authorization.

Mastercard debit transactions with stored credentials: Mastercard requires the submission of the Transaction Initiator Indicator for credit and debit card purchases that use a card’s stored data. The objective is to indicate whether the transaction was initiated by the shopper (Cardholder-Initiated Transaction - CIT) or by the e-commerce (Merchant-Initiated Transaction - MIT). In this scenario, it is mandatory to send the

InitiatedTransactionIndicatornode with theCategoryandSubCategoryparameters for Mastercard transactions, within thePaymentnode. Check out the list of categories in theCategoryparameter description and the full table of subcategories in Mastercard Transaction Initiator.

Attention: It is not possible to carry out a transaction with an amount (

Amount) 0. To check the validity of a card, use Zero Auth.

In the standard debit transaction (with authentication), send

Authenticate= “true”.

{

"MerchantOrderId": "2014121201",

"Customer": {

"Name": "Comprador Cartão de débito"

},

"Payment": {

"Type": "DebitCard",

"Authenticate": true,

"Amount": 15700,

"Tip":false,

"DebitCard": {

"CardNumber": "5551870000000181",

"Holder": "Teste Holder",

"ExpirationDate": "12/2030",

"SecurityCode": "123",

"Brand": "Master"

},

"ExternalAuthentication": {

"Cavv": "AAABB2gHA1B5EFNjWQcDAAAAAAB=",

"Xid": "Uk5ZanBHcWw2RjRCbEN5dGtiMTB=",

"Eci": "5",

"Version": "2",

"ReferenceID": "a24a5d87-b1a1-4aef-a37b-2f30b91274e6"

}

}

}

curl

--request POST "https://apisandbox.cieloecommerce.cielo.com.br/1/sales/"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--header "MerchantKey: 0123456789012345678901234567890123456789"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId":"2014121201",

"Customer":{

"Name":"Comprador Cartão de débito"

},

"Payment":{

"Type":"DebitCard",

"Authenticate":true,

"Amount":15700,

"Tip":false,

"DebitCard":{

"CardNumber":"5551870000000181",

"Holder":"Teste Holder",

"ExpirationDate":"12/2030",

"SecurityCode":"123",

"Brand":"Master"

},

"ExternalAuthentication":{

"Cavv":"AAABB2gHA1B5EFNjWQcDAAAAAAB=",

"Xid":"Uk5ZanBHcWw2RjRCbEN5dGtiMTB=",

"Eci":"5",

"Version":"2",

"ReferenceID":"a24a5d87-b1a1-4aef-a37b-2f30b91274e6"

}

}

}

--verbose

| Property | Description | Type | Size | Required |

|---|---|---|---|---|

MerchantId |

Store identifier in API E-commerce Cielo. | Guid | 36 | Yes |

MerchantKey |

Public Key for Double Authentication in API E-commerce Cielo. | Text | 40 | Yes |

RequestId |

Request Identifier, used when the merchant uses different servers for each GET/POST/PUT. | Guid | 36 | No |

MerchantOrderId |

Order identification number. Warning: Allowed characters are a-z, A-Z, 0-9. Special characters and blank spaces are not allowed. | Text | 50 | Yes |

Customer.Name |

Shopper’s name. | Text | 255 | No |

Customer.Status |

Shopper registration status in store (NEW / EXISTING) - Used for fraud analysis | Text | 255 | No |

Payment.Type |

Type of the payment method. | Text | 100 | Yes |

Payment.Amount |

Order amount (to be sent in cents). | Number | 15 | Yes |

Payment.Tip |

Tipping is a type of transaction available for credit or debit card, tokenized or not. If “true”, the transaction is identified as a tip, otherwise send Tip as “false”. | Boolean | — | No (default false) |

Payment.Authenticate |

Defines if the shopper will be directed to the issuing bank for the authentication of the card. | Boolean | — | Yes |

Payment.ReturnUrl |

URL to where the user will be redirected after payment. | Text | 1024 | Yes |

Payment.IsCryptocurrencyNegotiation |

Should be send as “true” if the transaction is to sell or buy criptocurrency. | Boolean | - | No (default false) |

Payment.DebitCard.CardNumber |

Customer’s card number. | Text | 19 | Yes |

Payment.DebitCard.Holder |

Customer’s name printed on the card. | Text | 25 | Yes |

Payment.DebitCard.ExpirationDate |

Expiration date printed on the card. | Text | 7 | Yes |

Payment.DebitCard.SecurityCode |

Security code printed on the back of the card. | Text | 4 | No |

Payment.DebitCard.Brand |

Card brand. | Text | 10 | Yes |

Payment.InitiatedTransactionIndicator.Category |

Transaction start indicator category. Valid only for Mastercard brand. Possible values: - “C1”: transaction initiated by the cardholder; - “M1”: recurring or installment transaction initiated by the store; - “M2” : transaction initiated by the e-commerce. |

string | 2 | Conditional. Required only for Mastercard. |

Payment.InitiatedTransactionIndicator.Subcategory |

Indicator subcategory. Valid only for Mastercard brand. Possible values: If InitiatedTransactionIndicator.Category = “C1” or “M1”CredentialsOnFile StandingOrder Subscription Installment If InitiatedTransactionIndicator.Category = “M2”PartialShipment RelatedOrDelayedCharge NoShow Resubmission See the table with the description of subcategories in Mastercard transaction start indicator. |

string | - | Conditional. Required only for Mastercard. |

Payment.ExternalAuthentication.Eci |

E-Commerce Indicator returned on the authentication process. | Number | 1 | Yes |

Payment.ExternalAuthentication.ReferenceId |

RequestID returned on the authentication process. |

GUID | 36 | Yes |

{

"MerchantOrderId": "2014121201",

"Customer": {

"Name": "Comprador Cartão de débito"

},

"Payment": {

"DebitCard": {

"CardNumber": "555187******0181",

"Holder": "Teste Holder",

"ExpirationDate": "12/2030",

"SaveCard": false,

"Brand": "Master",

"PaymentAccountReference": "IC722LCXBROSHBPIBK7B44MBXO5HF"

},

"Provider": "Simulado",

"AuthorizationCode": "635288",

"Tid": "0826104754051",

"ProofOfSale": "132471",

"Authenticate": true,

"Tip":false,

"ExternalAuthentication": {

"Cavv": "AAABB2gHA1B5EFNjWQcDAAAAAAB=",

"Xid": "Uk5ZanBHcWw2RjRCbEN5dGtiMTB=",

"Eci": "5",

"Version": "2",

"ReferenceId": "a24a5d87-b1a1-4aef-a37b-2f30b91274e6"

},

"Recurrent": false,

"Amount": 15700,

"ReceivedDate": "2022-08-26 10:47:53",

"CapturedAmount": 15700,

"CapturedDate": "2022-08-26 10:47:54",

"Status": 2,

"IsSplitted": false,

"ReturnMessage": "Operation Successful",

"ReturnCode": "6",

"PaymentId": "21c9a3e7-23c2-420b-b12d-b514ef271c85",

"Type": "DebitCard",

"Currency": "BRL",

"Country": "BRA",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.cieloecommerce.cielo.com.br/1/sales/21c9a3e7-23c2-420b-b12d-b514ef271c85"

}

]

}

}

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId": "2014121201",

"Customer": {

"Name": "Comprador Cartão de débito"

},

"Payment": {

"DebitCard": {

"CardNumber": "555187******0181",

"Holder": "Teste Holder",

"ExpirationDate": "12/2030",

"SaveCard": false,

"Brand": "Master",

"PaymentAccountReference": "IC722LCXBROSHBPIBK7B44MBXO5HF"

},

"Provider": "Simulado",

"AuthorizationCode": "635288",

"Tid": "0826104754051",

"ProofOfSale": "132471",

"Authenticate": true,

"Tip":false,

"ExternalAuthentication": {

"Cavv": "AAABB2gHA1B5EFNjWQcDAAAAAAB=",

"Xid": "Uk5ZanBHcWw2RjRCbEN5dGtiMTB=",

"Eci": "5",

"Version": "2",

"ReferenceId": "a24a5d87-b1a1-4aef-a37b-2f30b91274e6"

},

"Recurrent": false,

"Amount": 15700,

"ReceivedDate": "2022-08-26 10:47:53",

"CapturedAmount": 15700,

"CapturedDate": "2022-08-26 10:47:54",

"Status": 2,

"IsSplitted": false,

"ReturnMessage": "Operation Successful",

"ReturnCode": "6",

"PaymentId": "21c9a3e7-23c2-420b-b12d-b514ef271c85",

"Type": "DebitCard",

"Currency": "BRL",

"Country": "BRA",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.cieloecommerce.cielo.com.br/1/sales/21c9a3e7-23c2-420b-b12d-b514ef271c85"

}

]

}

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

AuthenticationUrl |

URL to where the e-commerce should redirect the shopper for the debit flow. | Text | 56 | Authentication URL |

Tid |

Transaction Id at the acquirer. | Text | 20 | Alphanumeric text |

PaymentId |

Payment ID number, needed for future operations like Queries, Capture and Cancellation. | Guid | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

ReturnUrl |

Return URL for the store. URL where the store will be redirected after the flow. | Text | 1024 | http://www.urlecommerce.com.br |

Status |

Transaction Status. Check out the Transactional Status codes table | Byte | — | 0 |

ReturnCode |

Acquirer return code. | Text | 32 | Alphanumeric text |

Payment.MerchantAdviceCode |

Card brand’s return code that defines the period for transaction submission retry.Valid only for Mastercard. See more at Mastercard Retry Program. | Text | 2 | Number |

Payment.DebitCard.PaymentAccountReference |

PAR (payment account reference) is the number that associates different tokens to the same card. It will be returned by the Master and Visa brands and passed on to Cielo e-commerce customers. If the card brand doesn’t send the information the field will not be returned. | Alphanumeric | 29 | - |

Cielo offers 3DS 2.0, a transaction authenticating protocol. Authentication is optional for credit cards transactions and required for debit cards transaction, as determined by issuing banks and card brands.

To integrate the authentication to your transactions:

ExternalAuthentication, as the following examples.{

"MerchantOrderId": "2014111701",

"Customer": {

"Name": "Comprador crédito completo",

"Email": "compradorteste@teste.com",

"Birthdate": "1991-01-02",

"Address": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"DeliveryAddress": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"Billing": {

"Street": "Rua Neturno",

"Number": "12345",

"Complement": "Sala 123",

"Neighborhood": "Centro",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BR",

"ZipCode": "20080123"

}

},

"Payment": {

"Currency": "BRL",

"Country": "BRA",

"ServiceTaxAmount": 0,

"Installments": 1,

"Interest": "ByMerchant",

"Capture": true,

"Authenticate": "false",

"Recurrent": "false",

"SoftDescriptor": "123456789ABCD",

"CreditCard": {

"CardNumber": "1234123412341231",

"Holder": "Teste Holder",

"ExpirationDate": "12/2030",

"SecurityCode": "123",

"SaveCard": "false",

"Brand": "Visa",

"CardOnFile": {

"Usage": "Used",

"Reason": "Unscheduled"

}

},

"IsCryptoCurrencyNegotiation": true,

"Type": "CreditCard",

"Amount": 15700,

"AirlineData": {

"TicketNumber": "AR988983"

}

}

}

curl

--request POST "https://apisandbox.cieloecommerce.cielo.com.br/1/sales/"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--header "MerchantKey: 0123456789012345678901234567890123456789"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId":"2014111701",

"Customer":{

"Name":"Comprador crédito completo",

"Identity":"11225468954",

"IdentityType":"CPF",

"Email":"compradorteste@teste.com",

"Birthdate":"1991-01-02",

"Address":{

"Street":"Rua Teste",

"Number":"123",

"Complement":"AP 123",

"ZipCode":"12345987",

"City":"Rio de Janeiro",

"State":"RJ",

"Country":"BRA"

},

"DeliveryAddress": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"Billing": {

"Street": "Rua Neturno",

"Number": "12345",

"Complement": "Sala 123",

"Neighborhood": "Centro",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BR",

"ZipCode": "20080123"

},

},

"Payment":{

"ServiceTaxAmount":0,

"Installments":1,

"Interest":"ByMerchant",

"Capture":true,

"Authenticate":false,

"Recurrent":"false",

"SoftDescriptor":"123456789ABCD",

"CreditCard":{

"CardNumber":"4551870000000183",

"Holder":"Teste Holder",

"ExpirationDate":"12/2030",

"SecurityCode":"123",

"SaveCard":"false",

"Brand":"Visa",

"CardOnFile":{

"Usage": "Used",

"Reason":"Unscheduled"

}

},

"IsCryptoCurrencyNegotiation": true,

"Type":"CreditCard",

"Amount":15700,

"AirlineData":{

"TicketNumber":"AR988983"

}

}

}

--verbose

| Propriedade | Tipo | Tamanho | Obrigatório | Descrição |

|---|---|---|---|---|

MerchantId |

GUID | 36 | Yes | Store identifier at Cielo. |

MerchantKey |

text | 40 | Yes | Public key for double authentication at Cielo. |

Content-Type |

header | 40 | Yes | application/json (required). |

RequestId |

GUID | 36 | No | Request Identifier, used when the merchant uses different servers for each GET/POST/PUT. |

MerchantOrderId |

text | 50 | Yes | Order identification number. Warning: Allowed characters are a-z, A-Z, 0-9. Special characters and blank spaces are not allowed. |

Customer.Name |

text | 255 | No | Customer’s name |

Customer.Status |

text | 255 | No | The customer’s registration status on the store. (NEW / EXISTING) |

Customer.Identity |

text | 14 | No | Customer’s RG, CPF or CNPJ. |

Customer.IdentityType |

text | 255 | No | Customer’s type of identification (CPF/CNPJ). |

Customer.Email |

text | 255 | No | Customer’s e-mail |

Customer.Birthdate |

date | 10 | No | Customer’s birth date (AAAA/MM/DD). |

Customer.Address.Street |

text | 255 | No | Customer’s address. |

Customer.Address.Number |

text | 15 | No | Customer’s address number. |

Customer.Address.Complement |

text | 50 | No | Customer’s address complement. |

Customer.Address.ZipCode |

text | 9 | No | Customer’s Zip Code |

Customer.Address.City |

text | 50 | No | Customer’s address’ city. |

Customer.Address.State |

text | 2 | No | Customer’s address’ state. |

Customer.Address.Country |

text | 35 | No | Customer’s address’ country. |

Customer.DeliveryAddress.Street |

text | 255 | No | Customer’s delivery address. |

Customer.Address.Number |

text | 15 | No | Customer’s delivery address number. |

Customer.DeliveryAddress.Complement |

text | 50 | No | Customer’s delivery address complement. |

Customer.DeliveryAddress.ZipCode |

text | 9 | No | Customer’s delivery address Zip Code. |

Customer.DeliveryAddress.City |

text | 50 | No | Customer’s delivery address city. |

Customer.DeliveryAddress.State |

text | 2 | No | Customer’s delivery address state. |

Customer.DeliveryAddress.Country |

text | 35 | No | Customer’s delivery address country. |

Payment.Type |

text | 100 | Yes | Type of the payment method. |

Payment.Amount |

number | 15 | Yes | Order Amount (to be sent in cents). |

Payment.Currency |

text | 3 | No | Currency in which the payment will be made (BRL). |

Payment.Country |

text | 3 | No | Country in which the payment will be made. |

Payment.Provider |

text | 15 | — | Defines the behavior for the payment method/NÃO OBRIGATÓRIO PARA CRÉDITO. |

Payment.ServiceTaxAmount |

number | 15 | No | Appliable only to airline companies. Order amount that will be destined to service tax. PS.: This amount is not added to the authorization amount. |

Payment.SoftDescriptor |

text | 13 | No | The store’s name that will be on the shopper’s bank invoice. Does not allow special characters. |

Payment.Installments |

number | 2 | Yes | Number of installments. If the transaction is a recurrence, the number of installments will be 1. For installment transactions, the number of installments will be greater than 1. |

Payment.Interest |

text | 10 | No | Type of installments - e-commerce (ByMerchant) or card (ByIssuer). |

Payment.Capture |

boolean | — | No (Default false) | Boolean that identifies if the authorization should be done by authomatic capture (“true”) or posterior capture (“false”). |

Payment.Authenticate |

Boolean | — | No (Default false) | Defines if the shopper will be directed to the issuing bank for card authetication. |

Payment.Recurrent |

boolean | - | Conditional | Indicates if the transaction is recurring (“true”) or not (“false”). The value “true” won’t originate a new recurrence, it will only allow a transaction without the need to send the security code. Authenticate should be “false” if Recurrent is “true”. Find out more about Recurring Payments. |

Payment.IsCryptocurrencyNegotiation |

boolean | - | No (default false) | Should be send as “true” if the transaction is to sell or buy criptocurrency. |

Payment.AirlineData.TicketNumber |

alphanumeric | 13 | No | Inform the number of the main airline ticket of the transaction. |

CreditCard.CardNumber |

text | 19 | Yes | Shopper’s card number. |

CreditCard.Holder |

text | 25 | Yes | Name of the shopper printed on the card. Does not accept special characters. |

CreditCard.ExpirationDate |

text | 7 | Yes | Expiration date printed on the card. E.g. MM/AAAA. |

CreditCard.SecurityCode |

text | 4 | No | Security code printed on the back of the card. |

CreditCard.SaveCard |

boolean | — | No (Default false) | Boolean that identifies if the card will be saved to generate a CardToken. Find out more about Tokenization of Cards. |

CreditCard.Brand |

text | 10 | Yes | Card brand. Possible values: Visa / Master / Amex / Elo / Aura / JCB / Diners / Discover / Hipercard / Hiper. |

CreditCard.CardOnFile.Usage |

text | - | No | First if the card was stored and it’s its first use. Used if the card was stored and has been used for another transaction before. |

CreditCard.CardOnFile.Reason |

text | - | Conditional | Indicates the motive for card storage, if the “Usage” field is “Used”. Recurring - Programmed recurring transaction (e.g. Subscriptions). If it is a recurring transaction, use Payment.Recurrent = true (merchant recurrence) or Recurrent.Payment = true (scheduled recurrence). Unscheduled - Recurring transaction with no fixed date (e.g. service apps) Installments - Installments through recurring transactions. |

{

"MerchantOrderId": "2014111706",

"Customer": {

"Name": "Comprador crédito completo",

"Identity": "11225468954",

"IdentityType": "CPF",

"Email": "compradorteste@teste.com",

"Birthdate": "1991-01-02",

"Address": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"DeliveryAddress": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"Billing": {

"Street": "Rua Neturno",

"Number": "12345",

"Complement": "Sala 123",

"Neighborhood": "Centro",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BR",

"ZipCode": "20080123"

}

},

"Payment": {

"ServiceTaxAmount": 0,

"Installments": 1,

"Interest": "ByMerchant",

"Capture": true,

"Authenticate": false,

"CreditCard": {

"CardNumber": "455187******0183",

"Holder": "Teste Holder",

"ExpirationDate": "12/2030",

"SaveCard": false,

"Brand": "Visa",

"PaymentAccountReference": "92745135160550440006111072222",

"CardOnFile": {

"Usage": "Used",

"Reason": "Unscheduled"

}

},

"IsCryptoCurrencyNegotiation": true,

"TryAutomaticCancellation": true,

"ProofOfSale": "674532",

"Tid": "0305020554239",

"AuthorizationCode": "123456",

"SoftDescriptor": "123456789ABCD",

"PaymentId": "24bc8366-fc31-4d6c-8555-17049a836a07",

"Type": "CreditCard",

"Amount": 15700,

"CapturedAmount": 15700,

"Country": "BRA",

"AirlineData": {

"TicketNumber": "AR988983"

},

"ExtraDataCollection": [],

"Status": 2,

"ReturnCode": "6",

"ReturnMessage": "Operation Successful",

"MerchantAdviceCode": "1",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.cieloecommerce.cielo.com.br/1/sales/{PaymentId}"

},

{

"Method": "PUT",

"Rel": "void",

"Href": "https://apisandbox.cieloecommerce.cielo.com.br/1/sales/{PaymentId}/void"

}

]

}

}

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId": "2014111706",

"Customer": {

"Name": "Comprador crédito completo",

"Identity":"11225468954",

"IdentityType":"CPF",

"Email": "compradorteste@teste.com",

"Birthdate": "1991-01-02",

"Address": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"DeliveryAddress": {

"Street": "Rua Teste",

"Number": "123",

"Complement": "AP 123",

"ZipCode": "12345987",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BRA"

},

"Billing": {

"Street": "Rua Neturno",

"Number": "12345",

"Complement": "Sala 123",

"Neighborhood": "Centro",

"City": "Rio de Janeiro",

"State": "RJ",

"Country": "BR",

"ZipCode": "20080123"

},

},

"Payment": {

"ServiceTaxAmount": 0,

"Installments": 1,

"Interest": "ByMerchant",

"Capture": true,

"Authenticate": false,

"CreditCard": {

"CardNumber": "455187******0183",

"Holder": "Teste Holder",

"ExpirationDate": "12/2030",

"SaveCard": false,

"Brand": "Visa",

"PaymentAccountReference":"92745135160550440006111072222",

"CardOnFile":{

"Usage": "Used",

"Reason":"Unscheduled"

}

},

"IsCryptoCurrencyNegotiation": true,

"TryAutomaticCancellation":true,

"ProofOfSale": "674532",

"Tid": "0305020554239",

"AuthorizationCode": "123456",

"SoftDescriptor":"123456789ABCD",

"PaymentId": "24bc8366-fc31-4d6c-8555-17049a836a07",

"Type": "CreditCard",

"Amount": 15700,

"CapturedAmount": 15700,

"Country": "BRA",

"ExtraDataCollection": [],

"Status": 2,

"ReturnCode": "6",

"ReturnMessage": "Operation Successful",

"MerchantAdviceCode":"1",

"Links": [

{

"Method": "GET",

"Rel": "self",

"Href": "https://apiquerysandbox.cieloecommerce.cielo.com.br/1/sales/{PaymentId}"

},

{

"Method": "PUT",

"Rel": "void",

"Href": "https://apisandbox.cieloecommerce.cielo.com.br/1/sales/{PaymentId}/void"

}

]

}

}

| Property | Description | Type | Size | Format |

|---|---|---|---|---|

ProofOfSale |

Authorization number, identical to the NSU. | text | 6 | Alphanumeric text |

Tid |

Transaction Id on the acquirer. | text | 20 | Alphanumeric text |

AuthorizationCode |

Authorization code. | text | 6 | Alphanumeric text |

SoftDescriptor |

Text that will be printed on the carrier’s bank invoice. Does not allow special characters. | text | 13 | Alphanumeric text |

PaymentId |

Payment ID number, needed for future operations like Queries, Capture and Cancellation. | GUID | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

ECI |

Eletronic Commerce Indicator. Indicates how safe a transaction is. | text | 2 | E.g. 7 |

Status |

Transaction status. Check out the complete Transactional status codes table. | byte | — | 2 |

ReturnCode |

Acquirer return code. | text | 32 | Alphanumeric text |

ReturnMessage |

Acquirer return message. | Text | 512 | Alphanumeric text |

MerchantAdviceCode |

Card brand’s return code that defines the period for transaction submission retry. Valid only for Mastercard. See more at Mastercard retry program | text | 2 | Number |

TryAutomaticCancellation |

In case of error during authorization (status “Not Finished - 0”), the response will include the “tryautomaticcancellation” field as “true”. In this case, the transaction will be automatically queried, and if it has been authorized successfully, it will be canceled automatically. This feature must be enabled for establishment. To enable, please contact our technical support. | boolean | - | true or false |

CreditCard.PaymentAccountReference |

PAR (payment account reference) is the number that associates different tokens to the same card. It will be returned by the Master and Visa brands and passed on to Cielo e-commerce customers. If the card brand doesn’t send the information the field will not be returned. | alphanumeric | 29 | — |

The debit transaction with authentication is the standard for this payment method. Follow the integration steps at the 3DS guide and send the request as shown in Creating a debit transaction.

The Merchant plug-in, known as MPI, is a service that allows you to make the call for authentication, integrated and certified with card brands for 3DS authentication processing. Cielo offers the merchant the 3DS integration through the Internal MPI or the External MPI.

Internal MPI: it is a service already integrated to 3DS Cielo, there is no need to integrate or hire.

External MPI: used when your e-commerce hires a MPI solution, without Cielo’s participation. No matter the 3DS version hired, follow the Authorization with Authentication guide.

The following tables apply to Mastercard credit and debit transactions with stored credentials. The objective is to identify whether the transaction was initiated by the cardholder or by the merchant:

The transaction initiator indicator must be sent in the node Payment.InitiatedTransactionIndicator, within parameters Category and Subcategory. Please refer to the following request example and tables for more information:

"Payment":{

(...)

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

(...)

}

"Payment":{

(...)

"InitiatedTransactionIndicator": {

"Category": "C1",

"Subcategory": "Standingorder"

},

(...)

}

For the full request example see Creating a credit card transaction or Creating a debit transaction.

| Property | Type | Size | Required | Description |

|---|---|---|---|---|

Payment.InitiatedTransactionIndicator.Category |

string | 2 | Conditional. Required only for Mastercard. | Transaction Initiator Indicator category. Valid only for Mastercard. Possible values: - “C1”: transaction initiated by the cardholder; - “M1”: recurring payment or installment initiated by the merchant - “M2”: transaction initiated by the merchant. |

Payment.InitiatedTransactionIndicator.Subcategory |

string | - | Conditional. Required only for Mastercard. | Transaction Initiator Indicator subcategory. Valid only for Mastercard. Please refer to the Transaction Initiator Indicator tables for the full list. |

The response will be the default response for the credit or debit transaction, returning the node Payment.InitiatedTransactionIndicator as sent in the request.

The categories (C1, M1 or M2) must be sent in parameter Payment.InitiatedTransactionIndicator.Category.

| Category | Transaction initiator | Description |

|---|---|---|

C1 |

Cardholder-initiated transaction (CIT). | The transaction is initiated by the cardholder. The cardholder provides card data and agrees with the merchant storing payment credentials or makes a purchase using previously stored payment credentials. The subcategory will indicate the reason for the purchase or for storing card data. |

M1 |

Merchant-initiated transaction (MIT). | The merchant has stored the payment credentials in the past (tokenized and with cardholder consent) and is authorized to initiate one or more transactions in the future for recurrent payments or installments. |

M2 |

Merchant-initiated transaction (MIT). | The merchant has stored the payment credentials in the past (tokenized and with cardholder consent) and is authorized to initiate one or more transactions in the future in order to charge for partial deliveries, related/delayed expenses, no-show fees and retry/resubmission. |

The subcategories must be sent in parameter Payment.InitiatedTransactionIndicator.Subcategory.

| Initiator category | Initiator subcategory | Meaning | Example |

|---|---|---|---|

C1 |

CredentialsOnFile |

Cardholder-initiated transaction in which the cardholder provides card data and agrees with the merchant storing payment credentials or makes a purchase using previously stored payment credentials. | The cardholder initiates the purchase and the merchant is authorized to save card data for future purchases initiated by the cardholder, such as one-click-buy. |

C1 |

StandingOrder |

Cardholder-initiated transaction in which the cardholder provides card data and agrees with the merchant storing payment credentials for future payments of fixed amount and variable frequency. | Initial transaction to store card data for utility bills monthly payments. |

C1 |

Subscription |

Cardholder-initiated transaction in which the cardholder provides card data and agrees with the merchant storing payment credentials for recurrent payments of fixed amount and frequency. | Initial transaction to store card data for a monthly subscription (e.g .newspapers and magazines). |

C1 |

Installment |

Cardholder-initiated transaction in which the cardholder initiates the first installment and authorizes the merchant to save card data for the next installments. | Initial transaction to store card data for installment buying |

M1 |

CredentialsOnFile |

Merchant-initiated unscheduled transaction of fixed or variable amount. | When the cardholder agrees with transactions for toll charges when the balance in their account is below a certain amount (auto-recharge). |

M1 |

StandingOrder |

Merchant-initiated transaction of variable amount and fixed frequency. | Utility bills monthy payments. |

M1 |

Subscription |

Merchant-initiated transaction of fixed amount and fixed frequency. | Monthly subscription or fixed monthly service payment. |

M1 |

Installment |

Merchant-initiated transaction of known amount and defined period. | If a shopper buys a TV for $600 and chooses to pay in three $200 installments; in this situation, the first transaction is initiated by the cardholder and the following two transactions are initiated by the merchant. |

M2 |

PartialShipment |

Merchant-initiated transaction when the order will be delivered in more than one shipping. | Partial shipment may occur when the amount of purchased goods in the e-commerce is not available for shipping in the time of purchase. Each shipping is a separate transaction. |

M2 |

RelatedOrDelayedCharge |

Merchant-initiated transaction for additional expenses, i.e., additional charges after providing initial services and processing the payment. | A hotel minibar fridge charges after cardholder check-out. |

M2 |

NoShow |

Merchant-initiated transaction for no-show charges according to the merchant cancellation policy. | The cancellation of a reservation by the cardholder without adequate prior notice to the merchant. |

M2 |

Resubmission |

Merchant-initiated transaction for retrying previously denied transactions. | The previous attempt to submit a transaction was denied, but the issuer response does not prohibit the merchant to retry, such as insufficient funds/response above credit limit. |

Important: Card data is stored in encrypted format.

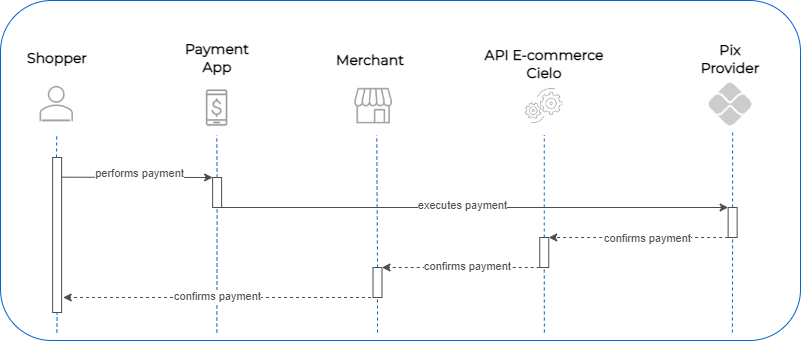

For Pix, the transmission for the payment order and the availability of funds for the receiver happens in real time, 24 hours a day and without the need of intermediaries. It is a payment method that allows fast and low cost transactions.

Before using Pix in production, certify that Pix is allowed in your account. To confirm, you just have to access Cielo portal in the logged in area go to Meu Cadastro > Autorizações > PIX

To enable Pix for the sandbox environment, get in touch with our E-commerce support e-mail: cieloecommerce@cielo.com.br;

Get to know the cycle of a Pix transaction:

| SEQUENCE | RESPONSIBLE | DESCRIPTION | TRANSACTION STATUS |

|---|---|---|---|

| 1 | E-commerce | Generating the QR code. | 12 - Pending |

| 2 | Shopper | Paying through the QR code. | 2 - Paid |

| 3 | E-commerce | Getting notified of the payment confirmation. | 2 - Paid |

| 4 | E-commerce | Consulting the transaction status. | 2 - Paid |

| 5 | E-commerce | Releasing the order. | 2 - Paid |

| 6 | E-commerce | If it’s necessary, requesting the Pix transaction refund (similar to a card refund). | 2 - Paid |

| 7 | E-commerce | Getting notified of the payment refund. | 11 - Refunded |

| 8 | E-commerce | Consulting the transaction status. | 11 - Refunded |

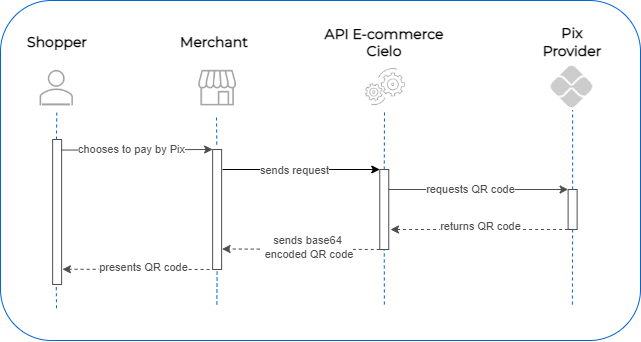

To generate a Pix QR code through the API E-commerce Cielo, simply perform the integration according to the following specification.

The required field Payment.Type should be sent as “Pix”. In the response, the Pix QR Code image code base64 will be returned and you should make it available to the shopper.

Check the transactional flow for generating a Pix QR Code:

The shopper then scans the QR code through one of the apps enabled for Pix and makes the payment. At this stage there is no participation from the e-commerce or the Cielo E-commerce API, as shown in the flow:

See the request and response examples for generating Pix QR Code:

{

"MerchantOrderId": "2020102601",

"Customer": {

"Name": "Nome do Pagador",

"Identity": "12345678909",

"IdentityType": "CPF"

},

"Payment": {

"Type": "Pix",

"Amount": 100

}

}

--request POST "https://(...)/sales/"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--header "MerchantKey: XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId":"2020102601",

"Customer":{

"Name":"Nome do Pagador",

"Identity":"CPF",

"IdentityType":"12345678909"

},

"Payment":{

"Type":"Pix",

"Amount":100

}

}

--verbose

| PROPERTY | DESCRIPTION | TYPE | SIZE | REQUIRED |

|---|---|---|---|---|

MerchantOrderId |

Order identification number. Warning: Allowed characters are a-z, A-Z, 0-9. Special characters and blank spaces are not allowed. | text | 50 | Yes |

Customer.Name |

Shopper name. | text | 255 | Yes |

Customer.Identity |

Shopper’s ID number (CPF/CNPJ) | text | 14 | Yes |

Customer.IdentityType |

Shopper’s type of ID (CPF or CNPJ). | text | 255 | Yes |

Payment.Type |

Payment type. In this case, “Pix”. | text | - | Yes |

Payment.Amount |

Payment value amount in cents. | number | 15 | Yes |

{

"MerchantOrderId":"2020102601",

"Customer":{

"Name":"Nome do Pagador"

},

"Payment":{

(...)

"Paymentid":"1997be4d-694a-472e-98f0-e7f4b4c8f1e7",

"Type":"Pix",

"AcquirerTransactionId":"86c200c7-7cdf-4375-92dd-1f62dfa846ad",

"ProofOfSale":"123456",

"QrcodeBase64Image":"rfhviy64ak+zse18cwcmtg==[...]",

"QrCodeString":"00020101021226880014br.gov.bcb.pix2566qrcodes-h.cielo.com.br/pix-qr/d05b1a34-ec52-4201-ba1e-d3cc2a43162552040000530398654041.005802BR5918Merchant Teste HML6009Sao Paulo62120508000101296304031C",

"Amount":100,

"ReceivedDate":"2020-10-15 18:53:20",

"Status":12,

"ReturnCode":"0",

"ReturnMessage":"Pix gerado com sucesso",

(...)

}

}

--header "Content-Type: application/json"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--data-binary

{

"MerchantOrderId":"2020102601",

"Customer":{

"Name":"Nome do Pagador"

},

"Payment":{

(...)

"PaymentId":"1997be4d-694a-472e-98f0-e7f4b4c8f1e7",

"Type":"Pix",

"AcquirerTransactionId":"86c200c7-7cdf-4375-92dd-1f62dfa846ad",

"ProofOfSale":"123456",

"QrcodeBase64Image":"rfhviy64ak+zse18cwcmtg==[...]",

"QrCodeString":"00020101021226880014br.gov.bcb.pix2566qrcodes-h.cielo.com.br/pix-qr/d05b1a34-ec52-4201-ba1e-d3cc2a43162552040000530398654041.005802BR5918Merchant Teste HML6009Sao Paulo62120508000101296304031C",

"Amount":100,

"ReceivedDate":"2020-10-15 18:53:20",

"Status":12,

"ReturnCode":"0",

"ReturnMessage":"Pix gerado com sucesso",

(...)

}

}

--verbose

| PROPERTY | DESCRIPTION | TYPE | SIZE | FORMAT |

|---|---|---|---|---|

Payment.PaymentId |

Payment ID number. | GUID | 40 | Text |

Payment.AcquirerTransactionId |

Transaction Id for the provider of the payment methods. | GUID | 36 | xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx |

Payment.ProofOfSale |

NSU Pix. | text | 20 | Alphanumeric Text |

Payment.QrcodeBase64Image |

Base64 code for the QR Code image. | text | - | Text |

Payment.QrCodeString |

Codified text for the shopper to copy and paste in the internet banking field for mobile payments. The availability of this code is the merchant’s responsibility. We recommend displaying a button that, when clicked, the shopper copies the code. | text | Variable | Alphanumeric Text |

Payment.Status |

Transaction status. In case of success, the inital status is “12” (Pending). See the transaction status list. | number | - | 12 |

Payment.ReturnCode |

Code returned by the provider of the payment method. | text | 32 | 0 |

Payment.ReturnMessage |

Message returned by the provider of the payment method. | text | 512 | “Pix successfully generated” |

If your store needs to cancel a pix transaction, it is possible to ask for a refund. It is important to point out that the refund is not immediate and it needs to be approved by the Pix provider. When it is approved, your store will get notified via Notification Post.

- The shopper must require to the store (merchant) the partial or total refund, through the store’s support channels;

- The merchant agrees with the refund and identifies the original Pix payment.

When to ask for a Pix refund?

Some example scenarios for requesting a Pix refund are product return, charge errors, and product not available in stock.

Who should request a Pix refund via API E-commerce Cielo

The store (seller who received the Pix transaction amount) should request the Pix refund for API E-commerce Cielo, in agreement with the shopper. Important: Be aware of time limits (regulated by Banco Central do Brasil).

How to ask for a Pix refund?

Via API E-commerce Cielo or App Cielo Gestão.

Pix refund rules

--request PUT "https://(...)/sales/{PaymentId}/void?Amount=xxx"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--header "MerchantKey: XXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXXX"

--header "RequestId: xxxxxxxx-xxxx-xxxx-xxxx-xxxxxxxxxxxx"

--verbose

| PROPERTY | DESCRIPTION | TYPE | SIZE | REQUIRED |

|---|---|---|---|---|

MerchantId |

Store identifier in Cielo. | GUID | 36 | Yes |

MerchantKey |

Public key for double authentication at Cielo. | text | 40 | Yes |

RequestId |

Request Identifier, used when the merchant uses different servers for each GET/POST/PUT. | GUID | 36 | No |

PaymentId |

Payment ID number. | GUID | 36 | Yes |

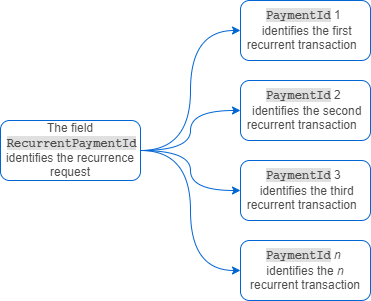

Amount |