Access the new E-commerce developers portal at docs.cielo.com.br.

Warning: The content on this page is being discontinued and will not receive updates after 09/16/2024. Please visit the new documentation at docs.cielo.br.

EMV 3DS, also known as 3DS 2.2 is an authentication technology developed by the payments industry in order to reduce the risk of fraud without harming the conversion rate. This new version analyzes several variables used as a criteria to determine the cardholder authencity, allowing in some cases decreased cardholder authentication interactions (challenges), without risking the merchant’s Liability Shift.

Main benefits:

Key words: Credit and Debit Card Authentication, EMVCO, 3DS 2.2, Visa, Mastercard, E-Commerce

3DS 2.2 is valid for all e-commerce transactions, whether debit, credit or prepaid. For segments that have a high rate of chargeback/fraud, the solution tends to be even more advantageous compared to the benefit of passing the liability shift to the issuing bank.

The merchant must attend the below requirements to use 3DS 2.2:

What is it?

Data Only is an optional field that can be used to contribute to the brand and issuer database, improving authentication performance.

Data Only can be used when the issuer does not perform authentication. In this case, if the Data only field was parameterized in the script, the brand will receive the parameterized data and share this information with the issuer. Over time, the issuer will have more transaction data for that card and the cardholder and will have more elements to perform authentication.

How to use Data Only?

Just parameterize bpmpi_auth_notifyonly. Authorization occurs in the same way as any [Authorization with Authentication].

To use Data Only, in Integração do script parameterize the field bpmpi_auth_notifyonly described in item Etapa de Autenticação – passo 3 – Mapeamento de classes.

In the Data Only model, additional 3DS 2.2 fields are mapped in the same way and sent to the brand, however, authentication is not requested

Data Only is valid for Mastercard and Visa brands.

For Data Only Mastercard, the ECI will always be 4;

For Data Only Visa, the ECI will always be 7.

What is the benefit of using Data Only?

Warning:

- In Data Only transactions, the risk of chargeback due to fraud remains with the merchant;

- It is possible to use Antifraude in 3DS Authentication transactions with Data Only.

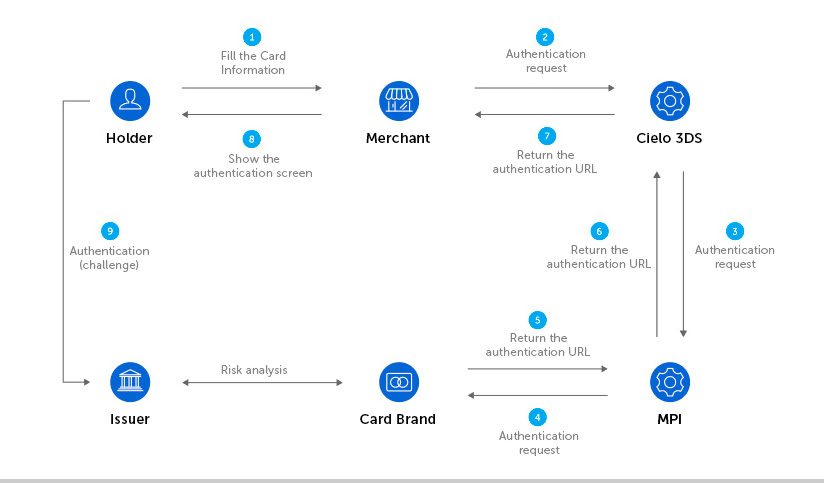

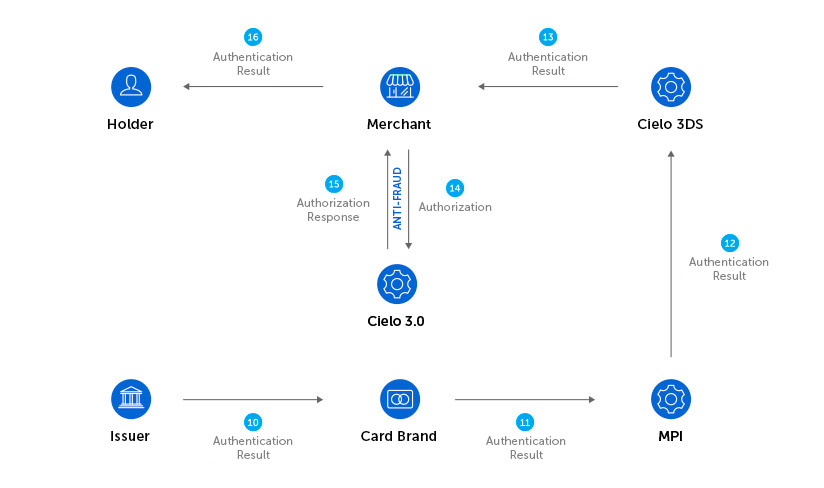

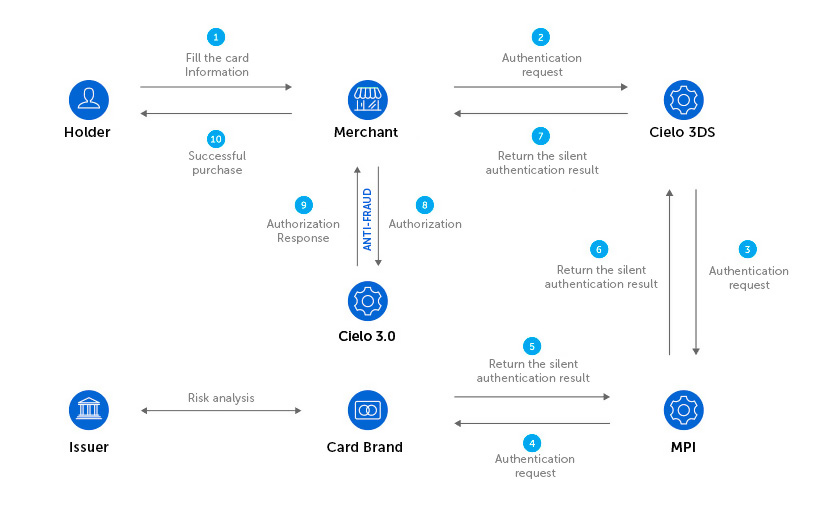

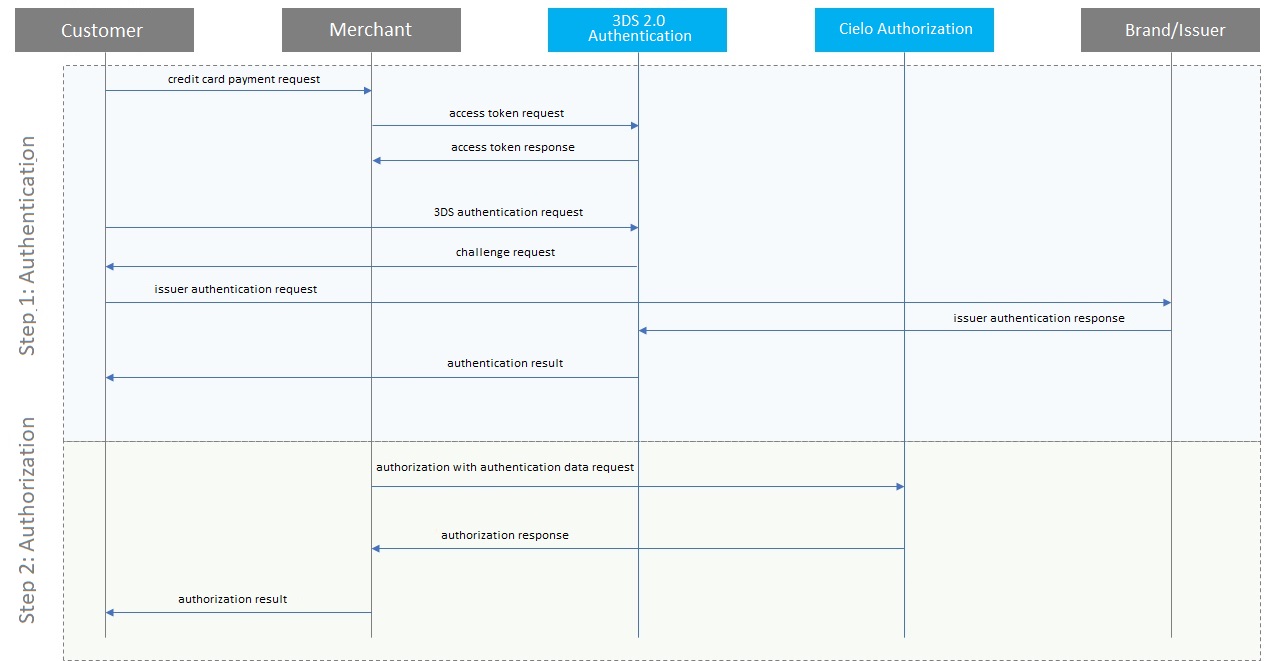

The authorization process using authentication through 3DS 2.2 occurs in two steps:

The steps below describes the detailed process:

The E-Commerce Indicator (ECI) is returned in the authentication process. This code is an indicator of what exactly occurred in the transaction authentication process.

Through ECI, it can be verified whether the transaction was authenticated and who was the agent responsible for that authentication. Check out the ECI table.

The solution is composed by the access token request via the API and authentication request via Java Script.

| Environment | Endpoint | Authorization |

|---|---|---|

| SANDBOX | https://mpisandbox.braspag.com.br | Basic (Authorization) The Authorization must be generated concatenating “ClientID”, colon character (“:”) and “ClientSecret” Ex. dba3a8db-fa54-40e0-8bab-7bfb9b6f2e2e:D/ilRsfoqHlSUChwAMnlyKdDNd7FMsM7cU/vo02REag= after this, encode the result in base 64. Then, this will generate an alphanumeric code that will be used in the access token request. For test purposes, use the following data: ClientID: dba3a8db-fa54-40e0-8bab-7bfb9b6f2e2e ClientSecret: D/ilRsfoqHlSUChwAMnlyKdDNd7FMsM7cU/vo02REag= |

| PRODUCTION | https://mpi.braspag.com.br | Please contact our support team to generate the “ClientID” and “ClientSecret” after integrating on sandbox environment. |

{

"EstablishmentCode": "1006993069",

"MerchantName": "Loja Exemplo Ltda",

"MCC": "5912"

}

curl

--request POST "https://mpisandbox.braspag.com.br/v2/auth/token"

--header "Content-Type: application/json"

--header "Authorization: Basic xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx"

--data-binary

--verbose

{

"EstablishmentCode":"1006993069",

"MerchantName": "Loja Exemplo Ltda",

"MCC": "5912"

}

| Parameter | Description | Type | Size |

|---|---|---|---|

| EstablishmentCode | Cielo E-commerce 3.0 affiliation code | Numeric | 10 |

| MerchantName | Merchant Name as registered on Cielo | Alphanumeric | Max 25 |

| MCC | Merchant category code | Numeric | 4 |

{

"access_token": "eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzI1NiJ9.eyJjbGllbnRfbmFtZSI6IlFBXzNEU19BdXRoZW50aWNhdG9yIiwiY2xpZW50X2lkIjoiZGJhM2E4ZGItZmE1NC00MGUwLThiYWItN2JmYjliNmYyZTJlIiwic2NvcGVzIjoie1wiU2NvcGVcIjpcIjNEU0F1dGhlbnRpY2F0b3JcIixcIkNsYWltc1wiOlt7XCJOYW1lXCI6XCJNZXJjaGFudE5hbWVcIixcIlZhbHVlc1wiOFwiVmFsdWVzXCI6W1wiNTU1NVwiXX0se1wiTmFtZVwiOlwiUmVmZXJlbmNlSWRcIixcIlZhbHVlc1wiOltcImY3MjE1YmQ3LWM0OTQtNGQ5Yi1NzEyfQ.daMqXko3dZOV0TzNFQ2vSsVSKqOsrwuswg7RB82ecAASSSSSSSSSSSSFFFFFFFFFFFFFGGGGGGGGGGGGGGGGGGGGGGGG",

"token_type": "barear",

"expires_in": "2018-07-23T11:29:32"

}

--header "Content-Type: application/json"

--data-binary

{

"access_token": "eyJ0eXAiOiJKV1QiLCJhbGciOiJIUzI1NiJ9.eyJjbGllbnRfbmFtZSI6IlFBXzNEU19BdXRoZW50aWNhdG9yIiwiY2xpZW50X2lkIjoiZGJhM2E4ZGItZmE1NC00MGUwLThiYWItN2JmYjliNmYyZTJlIiwic2NvcGVzIjoie1wiU2NvcGVcIjpcIjNEU0F1dGhlbnRpY2F0b3JcIixcIkNsYWltc1wiOlt7XCJOYW1lXCI6XCJNZXJjaGFudE5hbWVcIixcIlZhbHVlc1wiOFwiVmFsdWVzXCI6W1wiNTU1NVwiXX0se1wiTmFtZVwiOlwiUmVmZXJlbmNlSWRcIixcIlZhbHVlc1wiOltcImY3MjE1YmQ3LWM0OTQtNGQ5Yi1NzEyfQ.daMqXko3dZOV0TzNFQ2vSsVSKqOsrwuswg7RB82ecAASSSSSSSSSSSSFFFFFFFFFFFFFGGGGGGGGGGGGGGGGGGGGGGGG",

"token_type": "barear",

"expires_in": "2018-07-23T11:29:32"

}

| Parameter | Description | Type |

|---|---|---|

| access_token | Token required to continue with authentication | Alphanumeric |

| token_type | Fixed "Bearer" | Alphanumeric |

| expires_in | Token expiration time (minutes) | Numeric |

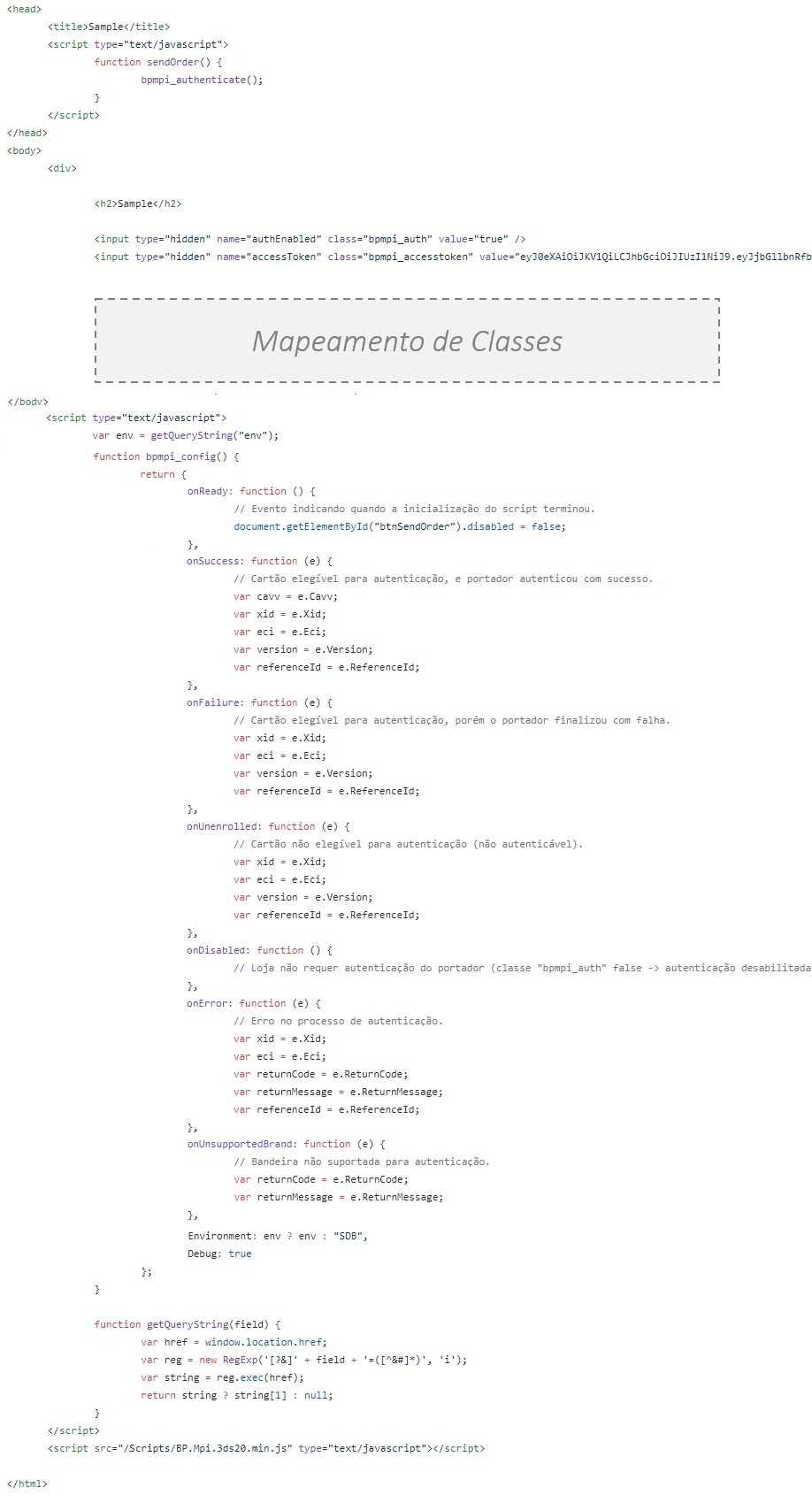

This step contains the script and the mapping of classes implementation responsable to comunicate with the authentication platform from brands and issuers. The example below shows the basic implementation. It is recommended that the snippet is placed at the end of the checkout HTML code:

To download the code, Click here

The events are actions that the script considers as a response for following the authentication process, but do not indicate if the transaction was successfully authenticated.

The ECI (E-commerce Indicator) is what indicates if the transaction was authenticated or not and the liability in case of chargeback. In order to sumbit a transaction for authorization, please consider the ECI value and use the events only as a complemenatry information for decision-making.

| Event | Description |

|---|---|

| onReady | This is triggered when the script is completely loaded, which includes validation of the access token, indicating that the checkout is ready to initiate authentication process |

| onSuccess | It is triggered when the card is elegible and the authentication process is successfully finished. In this case, the variables CAVV, XID and ECI are returned. These data must be sent in together with the authorization request. In this scenario, if the transaction is authorized, the liability shift is transferred to the issuer. |

| onFailure | It is triggered when the card is elegible but the authentication process failed for some reason. In this case, only ECI variable is returned. If the merchant decide to proceed with the authorization, the ECI must also be sent in the request. In this scenario if the transaction is authorized, the liability shift remains with the merchant. |

| onUnenrolled | It is triggered when the card is not elegible, in other words, the cardholder and/or issuer does not support the authentication program. In this case, guide the shopper to check with the issuer if the card is enabled to perform authentication in e-commerce. Only the ECI variable is returned. If the merchant decides to proceed with the authorization, the ECI must be sent together with the authorization. If the transaction is authorized, the liability shift remains with the merchant. |

| onDisabled | It is triggered when the merchant chooses not to submit the cardholder to the authentication process. ("bpmpi_auth" class set as false). In this scenario, if the transaction is authorized, the liability shift remains with the merchant. |

| onError | It is triggered when the authentication process receives a systemic error. In this scenario, if the transaction is authorized, the liability shift remains with the merchant. |

| onUnsupportedBrand | It is triggered when the card scheme is not supported by 3DS 2.2 |

| Parameter | Description | Type |

|---|---|---|

| Environment | Indicates the environment to be used (Sandbox or Production) | String SDB – Sandbox (test environment) PRD – Production (production environment) |

| Debug | Boolean that identifies if debug mode is activated. When sent as true, the platform will generate the report on the browser’s debug mechanism. | Boolean true false |

NOTE!

The JavaScript file must be saved in the server where the merchant application is hosted. To download the file on Sandbox environment, access:

Output Description

| Output | Description | Type | Size |

|---|---|---|---|

| Cavv | Authentication signature | Text | - |

| Xid | Authentication request ID | Text | - |

| Eci | E-commerce indicator code, which represents the authentication result | Numeric | Max 2 |

| Version | 3DS applied version | Numeric | 1 1.0 = 3DS 1.0; 2.0 = 3DS 2.0; |

| ReferenceId | Authentication request ID | GUID | 36 |

| ReturnCode | Authentication return code | Alphanumeric | Max 5 |

| ReturnMessage | Authentication result message | Alphanumeric | Variable |

Example for event OnSuccess

{

Cavv: 'Y2FyZGluYWxjb21tZXJjZWF1dGg=',

Xid: null,

Eci: '01',

Version: '2',

ReferenceId: '973cf83d-b378-43d5-84b6-ce1531475f2a'

}

Example for event OnFailure

{

Xid: null,

Eci: null,

ReturnCode: '231',

ReturnMessage: 'Unexpected error ocurred',

ReferenceId: null

}

Example when card brand is not supported for authentication

When tha card brand is not supported for 3DS, the MPI returns the code “MPI600” and the message “Brand not supported for authentication”.

{

Xid: null,

Eci: null,

ReturnCode: 'MPI600',

ReturnMessage: 'Brand not supported for authentication',

ReferenceId: null

}

Confira os valores possíveis de ReturnCodes na tabela Lista de Return Codes.

Classes that must be mapped in your HTML code.

Once the class is mapped to it’s given field, the script is able to retrieve the value contained in the field and submit it to compose the authentication request.

| Data Category | Field | Description | Type/Size | Required |

|---|---|---|---|---|

| Parameterization | bpmpi_auth |

Boolean indicating whether or not the transaction is submitted to the authentication process. | Boolean: true - submit to authentication false - don’t subit to authentication |

Yes |

| Parameterization | bpmpi_auth_notifyonly |

Boolean indicating whether the card transaction will be submitted in “notification only” mode. In this mode, the authentication process will not be triggered, however, the data will be submitted to the flag. VALID ONLY FOR MASTERCARD CARDS | Boolean: true - notification only mode; false - authentication mode |

No |

| Parameterization | bpmpi_auth_suppresschallenge |

Boolean that indicates if ignore or not the challenge. If the challenge is ignored, the liability will keep with the merchant. | Boolean: true – ignore challenge false – perform challenge |

Yes |

| Parameterization | bpmpi_accesstoken |

Token generated by Access Token API (step 1) | Alphanumeric (variable) | Yes |

| Order | bpmpi_ordernumber |

Merchant order number | Alphanumeric [max 50 positions] | Yes |

| Order | bpmpi_currency |

Currency code | Fixed “BRL” | Yes |

| Order | bpmpi_totalamount |

Total transaction amount (cents) | Numeric [max 15 positions] | Yes |

| Order | bpmpi_installments |

Number of Installments | Numeric [max 2 positions] | Yes |

| Order | bpmpi_paymentmethod |

Card type to be authenticated. If the card has both functions, it is necessary to specify the transaction type. | Credit - Credit Card Debit - Debit Card |

Yes |

| Order | bpmpi_cardnumber |

Card number | Numeric [max 19 positions] | Yes |

| Order | bpmpi_cardexpirationmonth |

Card expiration month | Numeric [max 2 positions] | Yes |

| Order | bpmpi_cardexpirationyear |

Card expiration year | Numeric [max 4 positions] | Yes |

| Order | bpmpi_cardalias |

Card alias | Alphanumeric [max 128 positions] | No |

| Order | bpmpi_default_card |

Indicates whether it is a standard customer card in the e-commerce | Boolean true - yes false - no |

No |

| Order | bpmpi_recurring_enddate |

End date of recurrency | Text (AAAA-MM-DD) | No |

| Order | bpmpi_recurring_frequency |

Frequency of recurrency | Number 1 - Monthly 2 - Bimonthly 3 - Quarterly 4 - Four Monthly 6 - Semester 12 - Annual |

No |

| Order | bpmpi_recurring_originalpurchasedate |

Date of first transaction that orignated the recurrency | Text (AAAA-MM-DD) | No |

| Order Description | bpmpi_order_recurrence |

Indicates whether it is an order that generates future recurrences | Boolean true false |

No |

| Order Description | bpmpi_order_productcode |

Product Type | PHY: purchase Goods CHA: Check acceptance ACF: Account financing QCT: Quasi-Cash Transaction PAL: Prepaid Activation and Load |

Yes |

| Order Description | bpmpi_order_countlast24hours |

Number of orders placed by same customer in the last 24 hours | Numeric [max 3 positions] | No |

| Order Description | bpmpi_order_countlast6months |

Number of orders placed by same customer in the last 6 months | Numeric [max 4 positions] | No |

| Order Description | bpmpi_order_countlast1year |

Number of orders placed by same customer in the last year | Numeric [max 3 positions] | No |

| Order Description | bpmpi_order_cardattemptslast24hours |

Number of orders placed with the same card in the last 24 hours | Numeric [max 3 positions] | No |

| Order Description | bpmpi_order_marketingoptin |

Indicates whether the shopper accepted to receive marketing offers | Boolean true - yes false - no |

No |

| Order Description | bpmpi_order_marketingsource |

Identifies the origin of the marketing campaign | Alphanumeric [max 40 positions] | No |

| Order Description | bpmpi_transaction_mode |

Identifies the channel from which the transaction originates | M: MOTO R: Varejo S: E-Commerce P: Mobile T: Tablet |

No |

| Order Description | bpmpi_merchant_url |

Address of the e-commerce’s web site | Alphanumeric [max 100 positions] Example: http://www.exemplo.com.br | Yes |

| Prepaid cards | bpmpi_giftcard_amount |

The total purchase amount for prepaid gift cards in rounded value | Numeric [max 15 positions], example: R$125,54 = 12554 |

No |

| Prepaid cards | bpmpi_giftcard_currency |

Transaction currency code paid with prepaid type card | Fixed “BRL” | No |

| Billing Address | bpmpi_billto_customerid |

Identifies the CPF/CNPJ of customer | Numeric [11 to 14 positions] 99999999999999 |

No |

| Billing Address | bpmpi_billto_contactname |

Billing address contact name | Alphanumeric [max 120 positions] | No |

| Billing Address | bpmpi_billto_phonenumber |

Billing address phone number | Numeric [max 15 positions], in the format: 5511999999999 | No |

| Billing Address | bpmpi_billto_email |

Billing address contact email | Alphanumeric [max 255 positions], in the format name@example.com | No |

| Billing Address | bpmpi_billto_street1 |

Street address and billing address number | Alphanumeric [max 60 positions] | No |

| Billing Address | bpmpi_billto_street2 |

Neighborhood and complement billing address | Alphanumeric [max 60 positions] | No |

| Billing Address | bpmpi_billto_city |

Billing address city | Alphanumeric [max 50 positions] | No |

| Billing Address | bpmpi_billto_state |

Billing address state | Text [2 positions] | No |

| Billing Address | bpmpi_billto_zipcode |

Billing address zip code | Alphanumeric [max 8 positions], in the format: 99999999 | No |

| Billing Address | bpmpi_billto_country |

Billing address country | Text [2 positions] e.g., BR | No |

| Delivery Address | bpmpi_shipto_sameasbillto |

Indicates it is the same address provided on the billing address | Boolean true false |

No |

| Delivery Address | bpmpi_shipto_addressee |

Shipping address contact name | Alphanumeric [max 60 positions] | No |

| Delivery Address | bpmpi_shipTo_phonenumber |

Delivery address phone number | Numeric [max 15 positions], in the format: 5511999999999 | No |

| Delivery Address | bpmpi_shipTo_email |

Delivery address contact email | Alphanumeric [max 255 positions], in the format name@example.com | No |

| Delivery Address | bpmpi_shipTo_street1 |

Street address and delivery address number | Alphanumeric [max 60 positions] | No |

| Delivery Address | bpmpi_shipTo_street2 |

Neighborhood and complement delivery address | Alphanumeric [max 60 positions] | No |

| Delivery Address | bpmpi_shipTo_city |

Delivery address city | Alphanumeric [max 50 positions] | No |

| Delivery Address | bpmpi_shipTo_state |

Accuracy of delivery address state | string [2 positions] | No |

| Delivery Address | bpmpi_shipto_zipcode |

Delivery address zip code | Alphanumeric [max 2 positions], in the format: 99999999 | No |

| Delivery Address | bpmpi_shipto_country |

Delivery address country | Text [2 positions], e.g., BR | No |

| Delivery Address | bpmpi_shipTo_shippingmethod |

Shipping method type | lowcost sameday oneday twoday threeday pickup other |

No |

| Delivery Address | bpmpi_shipto_firstusagedate |

Indicates the date of first use of the delivery address | Text AAAA-MM-DD - criation date |

No |

| Shopping Cart | bpmpi_cart_#_description |

Item description | Alphanumeric [max 255 positions] | No |

| Shopping Cart | bpmpi_cart_#_name |

Item name | Alphanumeric [max 255 positions] | No |

| Shopping Cart | bpmpi_cart_#_sku |

Item SKU | Alphanumeric [max 255 positions] | No |

| Shopping Cart | bpmpi_cart_#_quantity |

Cart item quantity | Numeric [max 10 positions] | No |

| Shopping Cart | bpmpi_cart_#_unitprice |

Unit value of the cart item (cents) | Numeric [max 10 positions] | No |

| User | bpmpi_useraccount_guest |

Indicates whether the customer is not logged (guest) | Boolean true - yes false - no |

No |

| User | bpmpi_useraccount_createddate |

Indicates the account creation date | String AAAA-MM-DD - creation date |

No |

| User | bpmpi_useraccount_changeddate |

Indicates the last change date of shopper’s account | String AAAA-MM-DD - last alteration date |

No |

| User | bpmpi_useraccount_passwordchangeddate |

Indicates the date when the shopper’s account password changed | Text AAAA-MM-DD - date of the last password change |

No |

| User | bpmpi_useraccount_authenticationmethod |

Shopper’s authentication method | 01 - No authentication 02 - Store login 03 - Login with federated ID 04 - Login with FIDO authenticator |

No |

| User | bpmpi_useraccount_authenticationprotocol |

Data that represents the login protocol carried out in the store | Alphanumeric [max 2048 positions] | No |

| User | bpmpi_useraccount_authenticationtimestamp |

The date and time the store was logged in | String [max 19 positions]YYYY-MM-ddTHH:mm:ss | No |

| User | bpmpi_merchant_newcustomer |

Indicates whether the consumer is a new or existing customer with the merchant | Boolean true – yes false – no |

No |

| Device | bpmpi_device_ipaddress |

IP address of the shopper’s machine | Alphanumeric [max 45 positions] | Conditional - required for Visa only |

| Device | bpmpi_device_#_fingerprint |

Id returned by Device Fingerprint | Alphanumeric [no limit] | No |

| Device | bpmpi_device_#_provider |

Device Fingerprint provider name | Alphanumeric [max 32 positions] cardinal inauth threatmetrix |

No |

| Device | bpmpi_device_#_channel |

Channel from which the transaction came from. Possible values: -Browser -SDK -3RI |

Alphanumeric [up to 7 positions] | Yes |

| Recurrence | bpmpi_recurring_type |

Recurring payment type. | Number 1 - First transaction 2 - Subsequent transaction 3 - Modification 4-Cancellation |

No |

| Recurrence | bpmpi_recurring_validationIndicator |

Indicates whether the recurring payment transaction was validated or not. | Number 0 - Not validated 1 - Validated |

No |

| Recurrence | bpmpi_recurring_maximumAmount |

Maximum amount agreed by the cardholder. | numeric [up to 12 positions] | No |

| Recurrence | bpmpi_recurring_referenceNumber |

Unique reference number for the recurring payment transaction. | Alphanumeric [up to 35 positions] | No |

| Recurrence | bpmpi_recurring_occurrence |

Indicates how often a recurring payment occurs. | Number 01 - Daily 02 - Twice a week 03 - Weekly 04 - Every ten days 05 - Fortnightly 06- Monthly 07 - Bimonthly 08 - Every three months 09 - Every four months 10 - Every six months 11 - Annually 12 - Unscheduled. |

No |

| Recurrence | bpmpi_recurring_numberOfPayments |

Total number of payments during the recurring subscription. | Number [up to 2 positions] | No |

| Recurrence | bpmpi_recurring_amountType |

Indicates the type of recurring amount agreed by the cardholder. | Supported values: 1 - Recurring payment of fixed value 2 - Recurring payment with maximum value. |

No |

| Airlines | bpmpi_airline_travelleg_#_carrier |

IATA code for the stretch | Alphanumeric [2 positions] | No |

| Airlines | bpmpi_airline_travelleg_#_departuredate |

Departure date | String AAAA-MM-DD |

No |

| Airlines | bpmpi_airline_travelleg_#_origin |

IATA code from origin airport | Alphanumeric [5 positions] | No |

| Airlines | bpmpi_airline_travelleg_#_destination |

IATA code from destination airport | Alphanumeric [5 positions] | No |

| Airlines | bpmpi_airline_passenger_#_name |

Passenger name | Alphanumeric [max 60 positions] | No |

| Airlines | bpmpi_airline_passenger_#_ticketprice |

Ticket price (cents) | Numeric [max 15 positions], example:R$125,54 = 12554 |

No |

| Airlines | bpmpi_airline_numberofpassengers |

Passenger number | Numeric [3 positions] | No |

| Airlines | bpmpi_airline_billto_passportcountry |

Code of the country that emitted the passport (ISO Standard Country Codes) | Text [2 positions] | No |

| Airlines | bpmpi_airline_billto_passportnumber |

Passport number | Alphanumeric [40 positions] | No |

| Merchant Defined Data | bpmpi_mdd1 |

Extra data defined by the merchant | Alphanumeric [max 255 positions] | No |

| Merchant Defined Data | bpmpi_mdd2 |

Extra data defined by the merchant | Alphanumeric [max 255 positions] | No |

| Merchant Defined Data | bpmpi_mdd3 |

Extra data defined by the merchant | Alphanumeric [max 255 positions] | No |

| Merchant Defined Data | bpmpi_mdd4 |

Extra data defined by the merchant | Alphanumeric [max 255 positions] | No |

| Merchant Defined Data | bpmpi_mdd5 |

Extra data defined by the merchant | Alphanumeric [max 255 positions] | No |

| Merchant Defined Data | bpmpi_brand_establishment_code |

Amex Establishment Code (EC) | Text [10 positions] | Required on Amex authentications |

The "bpmpi_Authenticate()" event must be requested when finishing the checkout(finishing the order). Example:

<input type="button"onclick="bpmpi_authenticate()" />

The ECI (Electronic Commerce Indicator) is a code returned by the brands and indicates the result of the cardholder’s 3DS authentication with the issuer or brand. Check the ECIs corresponding to each flag and the authentication result in the table below.

Subsequently, the ECI value must be sent in the transaction request in the

Payment.ExternalAuthentication.Ecifield

| Mastercard | Visa | Elo | Amex | Authentication result | Was the transaction authenticated? |

|---|---|---|---|---|---|

| 02 | 05 | 05 | 05 | Authenticated by the issuer – chargeback risk goes to the issuer. | Yes |

| 01 | 06 | 06 | 06 | Authenticated by the issuer – chargeback risk goes to the issuer. | Yes |

| Different than 01, 02 and 04 | Different than 05 and 06 | Different than 05 and 06 | Different than 05 and 06 | Not authenticated - chargeback risk remais with the merchant. | No |

| 04 | - | - | - | Not authenticated, transaction characterized as Data Only - chargeback risk remains with the merchant. | No |

Use the test cards below to simulate different scenarios in the SANDBOX environment

| CARD | FLAG | RESULT | DESCRIPTION |

|---|---|---|---|

| 4000000000001091 5200000000001096 6505290000001234 |

VISA MASTER ELO |

SUCCESS | Challenge authentication and bearer authenticated successfully |

| 4000000000001109 5200000000001104 6505050000001109 |

VISA MASTER ELO |

FAILURE | Challenged authentication and bearer authenticated failed |

| 4000000000001117 5200000000001112 6505050000001117 |

VISA MASTER ELO |

UNENROLLED | Challenge authentication currently unavailable |

| 4000000000001125 5200000000001120 6505050000001125 |

VISA MASTER ELO |

UNENROLLED | System error during authentication step |

| CARD | FLAG | RESULT | DESCRIPTION |

|---|---|---|---|

| 4000000000001000 5200000000001005 6505050000001000 |

VISA MASTER ELO |

SUCCESS | Unchallenged authentication and bearer successfully authenticated |

| 4000000000001018 5200000000001013 6505050000001018 |

VISA MASTER ELO |

FAILURE | Unchallenged authentication and bearer authenticated failed |

After authentication is completed, submit to the authorization procedure, sending the authentication data in the model of quot;external authentication" (node ExternalAuthentication ). This procedure is also valid for establishments that performed authentication outside Cielo (External MPI).

See example below, describing the Cielo E-commerce API authorization request authentication data:

{

"MerchantOrderId":"2017051002",

"Customer":

{

(...)

},

"Payment":

{

(...)

"Authenticate":true,

"ReturnUrl":"http://www.loja.com.br",

"CreditCard":{

"CardNumber":"4000000000001000",

"Holder":"Nome do Portador",

"ExpirationDate":"12/2021",

"SecurityCode":"123",

"Brand":"Visa",

"SaveCard":"false"

},

"ExternalAuthentication":{

"Cavv":"AAABB2gHA1B5EFNjWQcDAAAAAAB=",

"Xid":"Uk5ZanBHcWw2RjRCbEN5dGtiMTB=",

"Eci":"5",

"Version":"2",

"ReferenceID":"a24a5d87-b1a1-4aef-a37b-2f30b91274e6"

}

}

}

curl

--request POST "https://apisandbox.cieloecommerce.cielo.com.br/1/sales"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx"

--header "MerchantKey: xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx"

--data-binary

--verbose

{

"MerchantOrderId":"2017051002",

"Customer":

{

(...)

},

"Payment":

{

(...)

"Authenticate":true,

"ReturnUrl":"http://www.loja.com.br",

"CreditCard":{

"CardNumber":"4000000000001000",

"Holder":"Nome do Portador",

"ExpirationDate":"12/2021",

"SecurityCode":"123",

"Brand":"Visa",

"SaveCard":"false"

},

"ExternalAuthentication":{

"Cavv":"AAABB2gHA1B5EFNjWQcDAAAAAAB=",

"Xid":"Uk5ZanBHcWw2RjRCbEN5dGtiMTB=",

"Eci":"5",

"Version":"2",

"ReferenceId":"a24a5d87-b1a1-4aef-a37b-2f30b91274e6"

}

}

}

| Field | Description | Type/Size | Required |

|---|---|---|---|

Payment.Authenticate |

Boolean which defines whether the buyer will be directed to the issuing Bank for card authentication | Boolean | Yes, for authentication to be performed it is required to send as true |

Payment.ExternalAuthentication.Cavv |

Signature that is returned in authentication success scenarios | Text | Yes, when authentication was a success |

Payment.ExternalAuthentication.Xid |

XID returned in authentication process | Text | Yes, when the 3DS version is "1" |

Payment.ExternalAuthentication.Eci |

E-Commerce Indicator returned in authentication process | Numeric [1 character] | Yes |

Payment.ExternalAuthentication.Version |

3DS version used in authentication process | Alphanumeric [1 character] | Yes, when the 3DS version is "2" |

Payment.ExternalAuthentication.ReferenceId |

RequestID returned in authentication process | GUID [36 characters] | Yes, when the 3DS version is "2" |

See Cielo E-commerce API for the response.

After the authentication step in Data Only model is completed (field bpmpi_auth_notifyonly set as “true”), the transaction undergoes the authorization process by sending the authentication data in the “external authentication” model (node ExternalAuthentication).

See example below, describing the submission of authentication data from the Cielo E-commerce API authorization request, using POST:

{

"MerchantOrderId":"2017051002",

"Customer":

{

(...)

},

"Payment":

{

(...)

"Authenticate":false,

"ReturnUrl":"http://www.loja.com.br",

"CreditCard":{

"CardNumber":"4000000000001000",

"Holder":"Nome do Portador",

"ExpirationDate":"12/2027",

"SecurityCode":"123",

"Brand":"Visa",

"SaveCard":"false"

},

"ExternalAuthentication":{

"Eci":"4",

"ReferenceID":"a24a5d87-b1a1-4aef-a37b-2f30b91274e6",

"dataonly":true

}

}

}

--request POST "https://apisandbox.cieloecommerce.cielo.com.br/1/sales"

--header "Content-Type: application/json"

--header "MerchantId: xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx"

--header "MerchantKey: xxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxxx"

--data-binary

--verbose

{

"MerchantOrderId":"2017051002",

"Customer":

{

(...)

},

"Payment":

{

(...)

"Authenticate":false,

"ReturnUrl":"http://www.loja.com.br",

"CreditCard":{

"CardNumber":"4000000000001000",

"Holder":"Nome do Portador",

"ExpirationDate":"12/2027",

"SecurityCode":"123",

"Brand":"Visa",

"SaveCard":"false"

},

"ExternalAuthentication":{

"Eci":"4",

"ReferenceID":"a24a5d87-b1a1-4aef-a37b-2f30b91274e6",

"dataonly":true

}

}

}

| FIELD | DESCRIPTION | TYPE/SIZE | REQUIRED |

|---|---|---|---|

Payment.Authenticate |

Defines if the buyer will be directed to the issuing Bank for card authentication | Boolean (true or false) | Yes. For Data Only transactions the value must be “false” |

Payment.ExternalAuthentication.Eci |

E-commerce Indicator returned in authentication process | Numeric [1 position] | Yes |

Payment.ExternalAuthentication.ReferenceId |

RequestID returned in authentication process | GUID [36 positions] | Yes |

Payment.ExternalAuthentication.DataOnly |

Defines if transaction is Data Only | Boolean (true or false) | Yes. For Data Only transactions the value must be “true” |

See Cielo E-commerce API for detailed examples of Authorization with Authentication response.